If tax deduction appeals to you, then the form 1098 mortgage interest statement is something you’d be interested in. You’d need this, particularly if you are currently paying back the mortgage loan you used to buy your property. This simply means you can get a tax deduction on your mortgage interest using form 1098. What is this all about, how can I get one to reduce my tax, and are there IRS rules or regulations that guide the use of this form? This guide holds the key to everything you need to know about the form 1098 mortgage.

What Is Form 1098 Mortgage?

In the United States, mortgage providers must report any interest above $600; this is what form 1098 tends to achieve. A mortgage interest statement is a form sent by a mortgage provider to a borrower who paid more than $600 in a tax year. It is issued by the Internal Revenue Service (IRS) and is used to record the amount of interest and other related charges paid on a mortgage during the tax year so long as it is above $600.

This simply means if you do not pay up to $600 in interest on your mortgage for a year, you won’t need the form, nor is it necessary to file for it in the first place. Also, lenders file the form for every mortgage deal they get. So long as it pays up to $600 or more on interest.

Additionally, when examining Form 1098, make sure all of your personal information is correct, including your name, address, and tax identification number

Why Do We File Form 1098 Mortgage?

Generally, homeowners may get some tax deductions on interest, mortgage insurance payments, or points.

What Does a Typical Form 1098 Mortgage Contain?

Ideally, every form 1098 reports the following information;

- The taxpayer’s name, address, and taxpayer identification number

- Name, address, phone number, and taxpayer identification number of the lender

- The property’s address or a description

- The mortgage’s start date

- Points paid on a primary house purchase

- The amount of interest paid on a mortgage

- Any outstanding principal on your mortgage

- Refund made on overpaid interest.

- Premiums for mortgage insurance

- The number of properties used to secure the loan.

- The date on which the lender received the mortgage during the current calendar year

Tax Form 1098 Mortgage Interest: Key Uses

Before we highlight the key users of the form 1098 mortgage interest statement, let’s see something important. Anyone who intends to use the interest statement to reduce tax must plan to itemize the deductions on Schedule A. Generally, the tax deduction form 1098 has two key users even though it serves the same interest statement purpose.

Tax Form 1098 Mortgage Interest: Lenders

Lenders use the 1098 mortgage interest statement tax form to disclose interest payments totaling more than $600 for the year. This data is gathered by the IRS to guarantee that lenders and other businesses that receive interest payments are properly accounted for.

Tax Form 1098 Mortgage Interest: Homeowners

Homeowners are another group of people who use the 1098 interest statement tax form. This is mostly used when calculating the interest deduction on their annual tax returns.

How Does This work?

When calculating their mortgage interest deduction on their annual tax returns, homeowners use the form 1098 interest statement to calculate the total amount of interest they paid for the year.

Mortgage Interest Deduction Rules

Aside from the $600 or above rule guiding form 1098, there are other important rules you also need to know.

Rule 1

The first rule states that you must be the primary borrower and be current on your loan payment plan.

Rule 2

Interest can only be deducted on a $750,000 mortgage or less. This means if your mortgage is above $750,000, you wouldn’t be getting any interest deduction and, as such, there is no need for a form 1098 statement. However, if your mortgage dates back to 2017 or below, you are exempted from the $750,000 rule. You can get a tax reduction on your interest up to $1,000,000.

Rule 3

Absolute carefulness in filling out the form or face a penalty.

You need to be extra careful in filling out the boxes at each point, especially on the left part of the form. Firstly, information in boxes 1 through 9 and 11 is crucial tax information that will be submitted to the Internal Revenue Service. Therefore, the IRS may impose a penalty or other sanction if they find out that an underpayment of tax occurred because you overstated a deduction for this mortgage interest. So you could also be fined if you failed to report the interest refund (box 4), or for claiming a non-deductible item.

Filling a Form 1098 Mortgage Interest Statement

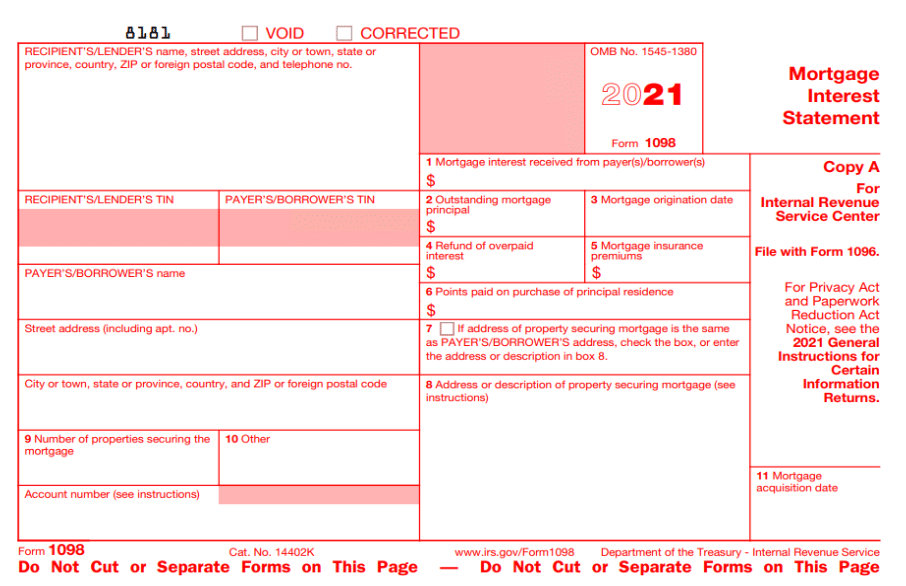

If you have received the 1098 mortgage form before, it means you already know how to effectively fill it out. But if you are receiving it for the first time, this is specifically for you. Generally, there are 11 boxes to pay attention to. These are as follows:

#1. Interest box

The interesting box has to do with the interest between you and your mortgage lender. This box displays the amount of interest you paid to your lender over the course of the year.

#2. Outstanding Principal

This box is specifically for the outstanding principal balance you owe your mortgage provider. It reveals the amount owed on the loan.

#3. Date Mortgage Originated

The third box on form 1098 mortgage is a column that reveals the original date your mortgage deal started. Generally, it reflects the start date of your mortgage.

#4. Refund Of Overpaid Interest

The box is a column that reflects how much you were refunded if you overpaid your interest. Simply put, It would be listed here if you had overpaid mortgage interest and had it reimbursed.

#5. Mortgage insurance premiums

The fifth box is a column for mortgage insurance premiums. The amounts you pay as a premium are recorded here irrespective of whether you’re paying private mortgage insurance or mortgage insurance premiums for the loan.

#6. Point Paid

The six boxes are set aside for the points paid on the purchase of the primary residence. This box displays the number of mortgage points that you may be eligible to deduct.

#7. Property Address and Borrower’s Address

For the seventh box, you will have to stick the box if the property address is the same as the borrower’s or payer’s home address.

#8. Property Address and Description

The eighth box is a column where you will have to put the property address or description.

#9. Number of Properties Securing Mortgage

This is where you put the number of properties securing the mortgage in question.

#10. Other

This is the column for every other relevant information.

#11. Mortgage acquisition Date

When it comes to the mortgage acquisition date is when the mortgage was purchased by the reporting lender listed on Form 1098. If the mortgage was sold to a lender who was not the original lender, the mortgage acquisition date would be used.

Form 1098 Interest Statement: Interface

A typical form 1098 mortgage interest statement is divided into two. The first part entails information about the mortgage lender and the borrower. While the second part includes the information necessary for a tax deduction,

Form 1098 Mortgage: Left Side

- Recipient or lender’s name, phone number, address, as well as postal code

- Recipient or lender’s Tin

- Payer’s Tin

- Payer’s or borrower’s name

- Street Address

What Is a 1098 Tax Form Used For?

The total amount of mortgage interest paid over the course of the preceding year is shown on Form 1098. It is used by taxpayers to determine the extent of the mortgage interest deduction they are eligible to claim for that tax year, if any.

Do I Need to File 1098?

You are not required to actually file Form 1098, i.e., submit it together with your tax return. You simply need to specify how much interest was reported on the form. Additionally, you typically only need to record this interest if you are itemizing your tax deductions.

Have there been changes to student loan interest deductions in 2023?

By extending the income phase-out range for married couples filing joint returns, the taxation of student loan interest will shift from tax year 2021 to tax year 2023. The range for single filers’ adjusted gross income phase out is $70,000 to $85,000, while the range for joint returns is $145,000 to $175,000.

What qualifies as related expenses for a Form 1098-T?

The IRS specifies fees and textbooks needed to enroll in or attend an eligible educational institution as connected costs for the purposes of this form in addition to qualified tuition.

Form 1098 Mortgage Interest Statement Template

Generally, the 1098 mortgage form comes in three parts, and they are as follows:

- Part A: This belongs to the Internal Revenue Service and it is mostly red in color.

- Part B: The second part belongs to the payers or borrowers.

- Part C: The third copy belongs to the recipient or lender.

Conclusion

Even though the tax deduction with mortgage interest statement isn’t such a large amount, people still report it annually in order to lower their tax liability. So if you really need a low tax liability or want a refund on tax payments, then you need to grasp the mortgage interest statement.

Form 1098 Mortgage FAQs

On what condition must a mortgage lender send Form 1098 to homeowners?

Lenders only send form 1098 mortgages to homeowners when they receive up to $600 in interest within a year. This simply means lenders who do not receive up to $600 in interest, mortgage insurance payments, or points throughout the year will not send these forms to their creditors.

How many types of form 1098 do we have in the States?

There are four major types of form 1098. These are as follows:

- Form 1098 Mortgage-for interest statement

- Form 1098-T for students’ Tuition Statement

- Form 1098-C for Contributions of Motor Vehicles, Boats, and Airplanes. This is filed by charities. Generally, it provides information for certain donations that the charities receive.

- Form 1098- E for Student Loan Interest Statement. This one reports student loan interest received from you by a lender throughout the year.

- 1096 Form Instructions: Everything You Need To Know

- Form 1065: Definition, Instructions, and Step By Step Guide

- Form 8396: Meaning, Instructions, And Where to Get The Form

- Mortgage: Simple 2023 Guide for Beginners and all you need Updated!!!

- Mortgage Notes: A Detailed Beginners’ Guide with Examples & Samples