When I was getting into the world of sales, I thought it was pretty straightforward. Sales is sales, as simple as ABC. The money earned from selling stuff. Only for me to start encountering terms like gross sales, net sales, gross profit and others.

Needless to say, I was a bit confused at first, so don’t panic if you are also having difficulty differentiating them. It’s very simple, actually; once you get the hang of it.

Key takeaways

Gross sales refer to the total sales of a business before deductions.

Gross sales report on numbers for a specific time period, e.g., weekly or quarterly.

Gross sales can sometimes be a misleading number when reported together with net sales.

You can plot your gross and net sales on a graph to determine a trend. If the difference between both lines increases, this could indicate a problem with the quality of the products.

What is gross sales?

Gross sales account for a business’s total income from its sales minus the cost of goods sold directly related to producing or otherwise supplying its products and services. It can also be used to calculate the total revenue, which is why a company’s sales are considered a subsection of its revenue.

In e-commerce, gross sales can be calculated by adding up the total price of all items sold, including taxes and shipping charges. It is a crucial metric for e-commerce sellers as it measures the overall health of their business.

Gross sales can be utilized to establish sales targets and track progress toward achieving them.

How to calculate gross sales

Gross sales are the all-inclusive monetary value generated by a company from the delivery of goods and services to customers in a specified period.

Unlike the net sales metric, a company’s gross sales are calculated before the following three adjustments:

- Returns → The reversal of payment, which is typically initiated by the customer (and typically requires the customer to return the product in question).

- Discounts → As an incentive to increase sales volume, a company can offer a discount to reduce the sales price, whereby the lower price is contingent on the customer completing a pre-specified event (e.g. submitting an earlier payment or an on-time payment could trigger a discount) — however, on the date of the actual sale, the company is unaware if the customer will meet the criteria to qualify for the discount.

- Allowances → A sales allowance refers to the reduction in the amount paid by a customer because of minor product defects that the customer points out. However, in such cases, rather than requesting a full refund, the seller and buyer come to an agreement in which a sales allowance (effectively a post-purchase discount) is granted to the buyer (who keeps the defective item).

These three adjustments to gross sales are deemed contra-accounts. Hence, they would show up as a credit to the sales account as opposed to a debit since they are designed to offset (and reduce) the sales amount.

Below is a checklist of steps you can follow to calculate your company’s sales:

How to calculate sales

Gross sales formula

Gross sales measure a company’s total sales without adjusting for the expenses of generating those sales. The gross sales formula is calculated by totaling all sale invoices or related revenue transactions. However, gross sales do not include operating expenses, tax expenses, or other charges, which are all deducted to calculate net sales.

The gross sales figure is calculated by adding all sales receipts before discounts, returns, and allowances together.

The formula for gross sales is a simple equation that helps businesses calculate their total revenue before any deductions:

Gross Sales = Sum of all sales (Total units sold x Sales price per unit).

Let’s look at an example.

Assuming your company calculates its total yearly sales at $600,000, with the cost of goods sold (COGS) for the same yearly period totaling at $150,000. You would calculate your gross sales using the formula

(gross sales) = (total sales) – (COGS).

Gross sales = ($600,000) – ($150,000) = $450,000.

You can then calculate your net sales by subtracting operating expenses and other sales-related costs from the gross sales.

Gross sales calculation example

Suppose an e-commerce store had 200k total product orders in the past fiscal year. Further, we’ll assume that the average sale price (ASP) of the company’s product line is $40.00 per item.

- Units Sold = 200,000

- Average Selling Price (ASP) = $40.00

The store’s gross sales are the product of the ASP and the number of units sold, which amounts to $8 million in gross sales.

- Gross Sales = 200,000 x $40.00 = $8 million

Why is gross sales important?

Gross sales can provide valuable insight into the overall health of your business. Tracking them over time can help you identify areas for improvement.

It is also valuable for establishing sales goals and tracking progress toward meeting them. Therefore, it is essential to monitor your gross sales and adjust your business strategy if you identify any areas for improvement.

Finally, gross sales can be used to calculate other significant metrics, such as gross profit and net sales. These metrics can help sellers understand their financial performance and make informed decisions about their business.

While gross sales can be important, especially for retail stores, it is not the final word on a company’s revenue. It reflects a business’s total revenue during a specific period but does not account for all the expenses accrued. This is why gross sales are not typically listed on an income statement or listed as total revenue. Net sales reflect a truer picture of a company’s top line.

Nevertheless, analysts often find it helpful to plot gross sales, net sales, and the difference between both figures to determine how each value trends over a period. If the difference between gross and net sales increases over time, this could indicate trouble with product quality. This is because it suggests an unusually high volume of sales returns, discounts, or allowances. These figures should be watched to determine their meaning.

Limitations of using gross sales

Gross sales are generally only significant to companies in the consumer retail industry, reflecting the amount of a product a business sells relative to its major competitors. A company may decide to present gross sales, deductions, and net sales on different lines within an income statement.

However, this is generally more confusing, so net sales are typically the only value presented. The figure can be misleading when gross sales are presented on a separate line because it tends to overstate sales and inhibits readers from determining the total of the various sales deductions.

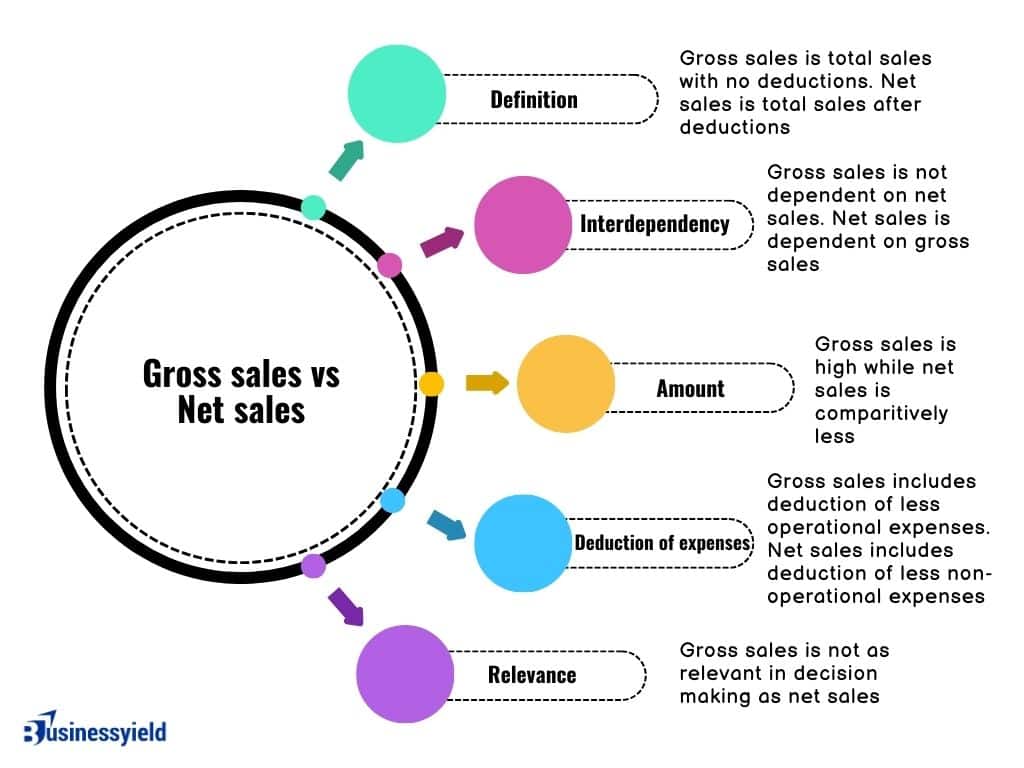

Gross sales vs. net sales: Key differences

Along with gross sales, net sales is another important metric that offers distinct advantages when it comes to gauging revenue. Yet not many people can tell the difference.

Net sales are the portion of revenue that remains after three types of deductions: allowances, discounts, and sales returns. This metric indicates a company’s profits, and it’s often reported on income statements.

Net sales are calculated by deducting the cost of sales—allowances, discounts, and returns—from the total revenue.

Net sales formula:

Gross sales (total revenue) – Allowances – Discounts – Sales returns = Net sales- Allowances are price reductions offered to customers who purchased a defective item. The customers get a discount but keep the faulty item instead of getting their initial payment back.

- Discounts are reduced prices offered to potential customers in order to motivate them to make a purchase. If the bookstore’s monthly discounts amount to $5,000, then gross sales go down to $116,500.

- Refunds are reimbursements given to buyers who return their purchases within a specified period of time.

Net sales calculation example

Following the example of the e-commerce store in the gross sales calculation above, to calculate the store’s net sales from our gross sales value, we must now deduct the three items as discussed earlier:

- Returns from Customers

- Discounts Offered

- Sales Allowances

For our hypothetical scenario, we’ll assume that a 10% discount was offered to customers who paid early, which was the case in 5% of all completed customer transactions.

The discount adjustment can be calculated as the product of the two inputs.

- (ASP x 10% Discount)

- (Number of Sales x 5% of Transactions)

The discount value comes out to $40,000.

- Discount = ($40.00 x 10%) x (200,000 x 5%) = $40,000

As for returns, we’ll multiply the number of returned transactions by the average selling price (ASP). If we assume 4% of all transactions were returned, there were 8,000 returns, meaning that the downward adjustment to gross sales is $320k.

- Returns = 8,000 × $40.00 = $320,000

Finally, we’ll assume that there were no sales allowances during this period.

In closing, the net sales of our company in the period are $7.64 million.

- Net Sales = $8 million – $40,000 – $320,000 = $7,640,000

Why you need to track both net sales and gross sales

Tracking your gross sales allows you to measure the total amount of revenue made by sales teams. In the same view, net sales give insight into the effectiveness of your team’s sales tactics as well as the quality of your products or services. Using both gross and net sales, you can understand how well your sales team is performing and how they can sell better.

Net sales allow a company to better evaluate its profits because they include deductions such as allowances, returns, and discounts. This metric can also help you identify which costs are creating the greatest losses in the sales process. A high volume of discounts might attract business but severely cut into your profits. On the other hand, many allowances and returns signal the customers aren’t getting enough value from your product or service.

You can also use net sales to set meaningful goals for your sales team. Determine how much more revenue your company needs to hit sales targets, and set realistic quotas for reps based on those metrics.

Although gross sales do not accurately represent a company’s profits, they do provide a baseline for measuring important sales metrics.

For example, it would be impossible to calculate gross profit margin—an essential metric that shows total revenue earned during a specific period and indicates whether resources are used efficiently—without gross sales. And, of course, you can only calculate the net sales of a business by using gross sales.

Is gross sales the same as gross revenue?

Gross sales account for a business’s total income from its sales minus the cost of goods sold directly related to producing or otherwise supplying its products and services. It can also be used to calculate the total revenue, which is why a company’s sales are considered a subsection of its revenue.

On the other hand, a business’s gross revenue is the total income earned from sales as well as non-operational income before any deductions and cost subtractions are made.

In most contexts, gross sales and gross revenue are interchangeable since both represent the total sales before any deductions.

Recommended Articles

- REVENUE BASED FINANCING: Definition, Types & Methods

- How to Get into Medical Sales With No Experience

- 7 Tried And Tested Marketing Strategies To Drive Revenue

- Inside Sales vs Outside Sales: Ways to Balance the Roles for Growth

- UNEARNED SERVICE REVENUE: Definition, Examples & Calculations

- What the Challenger Sales Model Is and How to Use It for Better Outcome

- Choosing Upselling & Cross-selling Strategies to Strengthen Your Sales Approach