Although California is commonly known for its association with famous actors and warm waterways, it is also a hub for businesses of various sizes and types. The state is a major contributor to the United States’ gross domestic product. Congratulations on launching a limited liability company (LLC) in California. As you commence your entrepreneurial journey, rest assured that you are not alone in this endeavor. This guide has been developed to provide assistance to individuals seeking to gain knowledge on the process of initiating a Limited Liability Company (LLC) in the state of California. Continue reading to discover the necessary steps to get an LLC in California procedure.

How to Get an LLC in California

The comparative analysis of a limited liability company with other business entities is a crucial aspect to consider while determining the appropriate business structure for your enterprise. The prevalent forms of business entities include sole proprietorships, partnerships, limited liability companies (LLCs), and corporations. An LLC is a business entity that combines the liability protection and tax advantages of a corporation with the flexibility and informality of a partnership.

#1. Pick a Distinctive Business Name and Conduct a Thorough State Business Search.

To establish your LLC, it is necessary to select a unique and recognizable name that is not currently in use by any other business entity registered within the state. In case of difficulty in generating a suitable name, it is recommended to utilize our Business Name Generator tool for potential ideas. It is necessary to adhere to general and state naming regulations. For detailed information, kindly refer to our California Business Names page. After choosing a name, it is necessary to verify its availability in California. Utilize our California entity search tool to determine if your preferred business name is already in use by another entity. The California Secretary of State’s website allows for name searches to be conducted.

#2. Give Your LLC an Official Address

Every California LLC must have an official address, which might be an office building, your home address (if you conduct the business from home), or any other physical site. The address may be located outside of the state, but it cannot be a P.O. Box. You may also be able to utilize a virtual mailbox as a business address. Incfile can supply you with a virtual mailbox in California, where we will receive your mail and scan it for you to review online. This is especially useful if you run a home-based business and don’t want your home address made public.

#3. Assign an Agent to Process the Service

A Registered Agent is required by most states for commercial enterprises. In California, it’s known as an Agent for Service of Process, but the objective is the same. We’ll use these terms interchangeably. The agent of a business entity gets official communications and is in charge of submitting reports to the Secretary of State. Each California LLC must have an Agent for the Service of the Process. When you submit your Articles of Organization, you will appoint an Agent for Service of the Process.

#4. Fill up and submit your Articles of Organization to the California Secretary of State.

Once you’ve gathered all of the necessary information for your LLC, you’ll draft your Articles of Organization. California makes this simple with a form and accompanying instructions. Filing it with the Secretary of State forms your LLC legally. On most forms, the following information is required:

- Your company’s name and address

- Your Process Server’s Contact Information

- The managerial structure of the company

- The organizer’s name

#5. Register with the IRS for an EIN (Employer Identification Number).

For tax purposes, your company cannot operate without an EIN. You’ll need this number for opening a business bank account, processing payroll, or filing tax returns. Either you apply or you can request one from the IRS as part of setting up your California LLC.

#6. Create a Company Charter

An LLC Operating Agreement acts as a “how-to” guide for the company’s management, including such topics as member roles, voting procedures, and what happens if a member resigns. You can’t launch a company in the Golden State of California without first drafting and signing an LLC Operating Agreement.

Online LLC Application

The phrase “legal entity” can cause apprehension among aspiring entrepreneurs and even experienced sole proprietors. One may inquire, “What does LLC stand for?” Many individuals share the same sentiment. Numerous novice entrepreneurs lack knowledge regarding the definition of a limited liability company and the initial steps to establish one, but they are aware of its significance in their business operations. If any of the following circumstances apply to you, there is no need to worry. Although the process of learning how to initiate an LLC may seem complex initially, it is a simple, multi-step procedure that involves a total of seven steps.

#1. Name Your LLC

LLCs are legal entities, so there are naming requirements. To avoid confusion with an already-registered business, your company’s name must be unique. It must include the terms LLC or limited liability company, and you cannot include financial terms such as insurance, trust, bank, or inc.

As with every other aspect of forming a limited liability company, state-specific regulations govern the formation of limited liability companies. On your state’s website, you can discover its laws. It is up to you whether your LLC and business name are the same or distinct. The selection was based on branding and marketing considerations. Your business’s registered legal structure is the name of your LLC, and you must include LLC when filing tax returns, opening business bank accounts, submitting loan applications, and filing litigation. If using LLC in your name is appropriate for your business, a distinct business name is unnecessary.

#2. Choose Your State

Regardless of your location, you have the option to register and establish your LLC in any U.S. state. In most cases, your native state is the most convenient option. Because local solicitors and attorneys are familiar with their native state’s LLC formation and operating regulations, it is advantageous to have government offices nearby. LLC owners choose to register their businesses out-of-state due to reduced startup, operating, self-employment, and sales taxes. In order to register your preferred business type in a state other than your own, you must provide a tangible mailing address. You can designate a registered agent’s office to represent you. Each of the fifty states has a website that explains how to form and manage an LLC.

#3. File Articles of Organization

The first step in getting your business registered is to send your state an “article of organization” form. States often use different terms, like “certificate of formation” or “certificate of association,” for the same thing. You can get a free copy of the articles of organization form from the webpage for your state. Depending on the state, filing fees can be anywhere from $50 to $800. Once accepted, you’ll get a state certificate of organization that proves your LLC exists as a legal entity in your state. That’s great news because it means you can do business.

#4. Pick a “Registered Agent.”

Most people who want to start an LLC want to know, “Can I set up an LLC on my own?” Yes, but you need a registered person and a registered office because of due process, no matter where your LLC is. A registered agent is a person who will get legal and other papers for your business, like subpoenas, regulatory and tax warnings, and letters. In most places, if someone wants to sue you, the court can’t do anything until they’ve given you notice. And to do that, you need a registered address and to be open to the public during work hours. Depending on the rules in your state, you could name yourself or your business as the registered agent for your company.

#5. Create a Partnership Agreement

An operating agreement documents the formation, organizational structure, daily responsibilities, and general rules of your LLC. In the majority of states, an LLC is not required to draft an operating agreement. But you’ll need one if you’re seeking investors or wind up in court due to internal disagreements between partners (it happens). An operating agreement addresses essential points, such as each member’s responsibilities, profit, and loss allocation, and procedures when a member wishes to leave or sell their share, among other things.

#6. Request an EIN

The Employer Identification Number (EIN), also known as the Federal Tax Identification Number, identifies a business entity. The IRS assigns this nine-digit number to taxpayers who are required to submit business tax returns.

Free LLC California

Before forming a California LLC, you must comprehend the state’s eligibility and compliance requirements. Thus, you will know what to expect and how to successfully operate and expand your business.

#1. Select a Company Name

Choose a business name that accurately represents your company and creates a positive first impression, while adhering to California LLC naming conventions. Avoid deceptive names and include “LLC” in your business’s name. Your selected business name must not already be in use by another business entity in the state. Conduct a business name search to ensure that your chosen business name is distinct and not too similar to that of an existing company.

#2. Reserve a Business Name and Domain

Once you’ve found the perfect business name, it’s a good idea to reserve it so that no one else may use it until you finish the registration procedure. You can reserve your name for 60 days by submitting a fee-based application. While you’re registering your business name, you should also reserve a domain name that corresponds to your business name. If you intend to employ social media marketing, make sure your multiple social media accounts have similar names.

#3. Select an LLC Type

Choose whether you want to form a domestic or international LLC in California. If you currently have an LLC in another state and want to operate in California, you must register your company as a foreign LLC in the state. You’ll also need to decide whether to form a member-managed or manager-managed LLC. The former is administered by LLC owners who make decisions on behalf of the LLC. In the latter situation, you must designate management to run and manage your LLC.

#4. Make an Operating Agreement for your LLC

Every California Limited Liability Company is obliged to have an LLC operating agreement, albeit they are not obligated to file it. This is a crucial document that defines how the LLC should be managed. Your California LLC operating agreement specifies each member’s rights, management rules, dissolution criteria, succession plan, and other details. Operating agreements govern how an LLC operates and makes decisions.

#5. Submit Your California LLC Information Statement

If you form an LLC in California, you must file a California Statement of Information within 90 days of registration. Following that, you must file this declaration every two years to keep your firm going. There is a $20 filing fee if you do this online, by mail, or in person. You must pay this fee each time you file your biannual report. In California, you must file Form LLC-12 with the Secretary of State.

File LLC Online California

Here are some more specifics on each step:

#1. Select a Name for Your LLC.

Your LLC name must be unique and cannot be the same as or similar to the name of any existing California business entity. The California Secretary of State’s website allows you to verify the availability of names.

#2. File the Articles of Organization With the California Secretary of State.

The Articles of Organization is a legal document that governs the formation of your LLC. You can submit them either online or by mail. The fee for filing is $70.

#3. Make Payment for the Filing Fee.

In California, the filing fee for an LLC is $70. You can pay the charge either online or via mail.

#4. Request an EIN from the IRS.

An EIN is a nine-digit number that your business uses to identify itself for tax purposes. You can apply for an EIN either online or via mail.

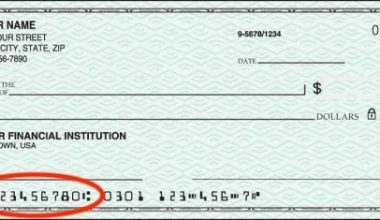

#5. Establish a Business Bank Account.

A business bank account will assist you in keeping your business and personal finances separate. Any bank or credit union can open a business bank account for you.

#6. Purchase a Business License.

Depending on the nature of your business, you may be required to obtain a business license from the city or county where you operate. Your local government’s website will include information on company licensing.

#7. Submit Your Annual Report.

You must file an annual report with the California Secretary of State every year. The annual report contains information regarding your LLC, such as its name, address, and officers. You can submit your annual report either online or via mail.

Cheapest Way to Form an LLC in California

The simplest and least expensive way to form an LLC in California is to file the articles of organization and pay the filing fee online at the California Secretary of State’s website. As of 2021, the filing fee is $70. It is also necessary to file a Statement of Information, which has a filing fee of $20. There are also continuous compliance obligations, such as filing an annual tax return and paying the annual franchise tax. It’s a good idea to talk to a lawyer to make sure you understand all of the procedures and obligations of forming an LLC in California.

California has dropped its standard filing fee to $0 through June 30, 2023, making now the optimum time to incorporate an LLC in California. This means that your state filing fees will only comprise the $20 price for your LLC’s mandated Initial Statement of Information and any state fees for optional items. The simplest approach to incorporate an LLC is through a registered agent, which will help you make fewer mistakes. The simplest approach to forming an LLC is to apply for some items yourself, such as an EIN, a bank account, and a company address. Allow only the registered agent to form the company. The cost of forming an LLC on Northwest is inexpensive, as low as $39 plus state fees. Their pricing structure is straightforward; there are no hidden fees or upsells. They will not sell client information because they do not co-sell with third-party services.

How Much Does It Cost to Start an LLC in California?

Fee for a California LLC. The CA LLC charge is $85, payable to the secretary of state. A California LLC fee of $20 is also required for the statement of information, which must be submitted within 90 days of the creation of the LLC.

Can I Form a Single-Member LLC in California?

You are a single-member limited liability corporation (SMLLC) if your LLC has only one owner. If you are married, you are considered one owner and can choose to be recognized as an SMLLC. Even though an SMLLC is a disregarded entity for tax purposes, we require them to complete Form 568.

Can I File an LLC on My Own in California?

To form an LLC in California, go to bizfileOnline.sos.ca.gov, login, pick Register a Business under the Business Entities Tile, Articles of Organization – CA LLC, and complete and submit the forms.

How Do I Qualify for an LLC in California?

In California, forming an LLC necessitates two separate filings: Articles of Incorporation and a Statement of Information. In California, your Articles of Incorporation constitute your business, and the Statement of Information is a periodic file that is required within 90 days of formation.

What Is the Fastest Way to Start an LLC in California?

The quickest approach to get your California LLC up and running is to file your paperwork online. Send your application by mail. Download and complete Form LLC-1 (Articles of Organization) to file by mail.

How Long Does It Take for an LLC to Be Approved in California?

Mail filings: Mail filing approvals for California LLCs typically take 3 weeks. This includes the processing period of 8 working days as well as the time your documents are in the mail. Online filing approvals for California LLCs take an average of 8 business days.

How Much Taxes Does an LLC Pay in California?

Every California-based LLC must pay an annual tax of $800. Even if you are not an operational business, you must pay this yearly tax until you cancel your LLC. You must pay your first-year annual tax by the 15th day of the fourth month following the day you file with the SOS.

Conclusion

The good news is that there aren’t many disadvantages to forming an LLC in California. Aside from being a beautiful place to reside, basically, an LLC is a reasonably simple corporate structure to establish and operate. When it comes to taxation and formation, you’ll get the best of both worlds. For more information on how to get an LLC in California, please visit the California Secretary of State’s website.

Related Articles

1. HOW TO START A REAL ESTATE BUSINESS IN 2023: Detailed Guide!!!

2. WHAT ARE ARTICLES OF ORGANIZATION? Detailed Explanation

3. LLC ADVANTAGES AND DISADVANTAGES: What You Need