The issue of Fibonacci retracements is one that piques a lot of people’s interests. One needs to have an understanding of the Fibonacci strategy and extension before one can completely understand and appreciate the concept of Fibonacci retracement. The Fibonacci series can be traced back to the ancient Indian mathematic texts, with some claims dating back as far as 200 BC. This is the first known use of the series. On the other hand, in the 12th century, an Italian mathematician from Pisa named Leonardo Pisano Bogollo, who was better known to his companions as Fibonacci, discovered the Fibonacci numbers. How to calculate and use Fibonacci retracement levels will be discussed in this article.

What Is Fibonacci Retracement?

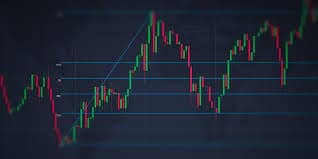

Fibonacci Retracement is a ratio that can be utilized to find possible turning points. The sequence is a well-known place to look for certain proportions. The 61.8% and 38.2% Fibonacci Retracements are the most common. The percentages 38.2 and 61.8 are frequently reduced to 38% and 62%, respectively. Fibonacci ratios are used by technical analysts to determine retracement levels and predict the size of a correction or pullback after a gain. After a drop, the duration of a counter-trend rally can be estimated using a Fibonacci Retracement. The Fibonacci retracement can form part of a bigger strategy when used in conjunction with other indicators and price patterns.

Furthermore, If you are a frequent trader, you may have noticed that prices of financial assets tend to trend in certain ways. Consolidation between different price points is a trend that appears frequently.

In the financial markets, it is common for assets to consolidate their recent movement within a narrow trading range before making another range-bound move. Even during market trends, prices tend to aim for certain regions before moving on. Fibonacci retracement analysis is a useful tool for price forecasting.

In addition, the retracement analysis is able to verify an entry point, establish a take-profit objective, and fix a stop loss.

How Do Fibonacci Retracement Works?

The first thing you need to understand about the Fibonacci retracement is that it works most effectively when the market is moving in a certain direction. When the market is moving in an upward direction, the strategy to employ is to buy on a retracement that occurs at a Fibonacci support level and then go long.

And when the market is moving in a downward direction, to enter a short position (or sell) on a pullback at a Fibonacci resistance level. Retracement levels based on the Fibonacci sequence are regarded as a type of predictive technical indicator since they make an effort to forecast where prices may be located in the near future.

After beginning a new trend direction, prices are thought to retrace, or return partway, to a previous price level before continuing in the direction of their trend. This is the central tenet of the hypothesis.

How to Use Fibonacci Retracement

In order to use Fibonacci retracement patterns, simply divide the horizontal distance between the high point and the low point by one of the essential Fibonacci ratios. To do this, horizontal lines are drawn on the trading chart at the percentage points 0.0%, 23.6%, 38.2%, 50%, 61.8%, and 100% respectively. Traders also like to utilize the ratio of 50.0%, despite the fact that it is not an official Fibonacci ratio. This is because the price will often go back about 50% before going back in its original direction.

Fibonacci retracement levels can be used to:

- Determine which levels of support and resistance exist;

- Make sure to place any stop-loss orders;

- Set target prices;

- Serve as the primary trading mechanism for trading against the trend (a swing trading strategy that attempts to make small gains by trading against the prevailing trend).

The Fibonacci retracement also works for foreign exchange, equities, commodities, cryptocurrencies, futures, options, and index funds.

In addition to this, it is appropriate for all timeframes, including day trading as well as investing for the long term. On the other side, longer time periods have more weight when calculating the predictive value. This is the case with the vast majority of technical indicators. This is because the price will often go back about 50% before going back in its original direction.

Additionally, the levels of the Fibonacci retracement sequence and strategy are useful in other aspects of technical analysis. For instance, they play a significant role in Gartley patterns, which are chart patterns that are determined by Fibonacci ratios, and Elliott Wave theory (examining long-term trends in price patterns and how they correspond with investor sentiment).

Is Fibonacci a Leading or Lagging Indicator?

Retracement and extension process control on the Fibonacci sequence is regarded as leading indicators because they make an effort to anticipate where the price may move next before it actually does so. It is important to keep in mind that leading indicators are not always accurate; sometimes the price will move in the direction that the indicator points, and occasionally it will not.

Fibonacci Retracement Levels

Fibonacci retracement levels, when applied to trading charts, show how much of an asset’s value has been exchanged during a given timeframe and can be utilized as important turning points in the trend direction. Minute, hourly, daily, and weekly periods are all used by traders for a variety of purposes, including spotting trends and locating support and resistance.

When you plot the retracement levels on your charts, you’ll see that they coincide neatly with major highs and lows. Because they consistently reveal where price has reversed from a new trend, these high-probability zones serve as ideal entry or exit opportunities for trading.

Beginner traders who try to learn Fibonacci can learn more about the mood, volatility, and trendlines of the market.

What Are Fibonacci Retracement Levels?

The Fibonacci retracement levels are a type of support and resistance that is calculated using the Fibonacci sequence and strategy. These percentages are 23.6, 38.1, 61.8, and 78.5 respectively. Your trading software may include the 50% level in its Fibonacci level drawings even though it is not a valid level.

Fibonacci retracement levels are widely believed to be predictive of future price movements. Support and resistance levels are set when enough traders use them as reference points.

Prices, the theory goes, never move in a perfectly straight line. It’s possible for the current trend to pause for a pullback after a strong price movement. Market participants can use Fibonacci retracement levels as landmarks to determine where support and resistance are likely to form. Fibonacci is a widely utilized technical indicator in technical analysis.

How to Draw Fibonacci Retracement Levels

When drawing Fibonacci retracement levels, there are some guidelines that must be followed, but there is also room for judgment. Wherever you select to begin measuring the Fibo retracement is where the process begins. Depending on what they considered to be a key low or high, two traders could end up with different results. If you’re just starting off, I recommend practicing on the higher timeframe charts first. Here are steps to draw the Fibonacci retracement levels:

- Locate the high and low points

- Join the extremes (high and low) together

- Make use of the Fibonacci retracement/resistance levels.

Calculate Fibonacci Retracement

Finding Fibonacci retracement levels does not follow any hard-and-fast formula to calculate. Support and resistance levels are not shown on a stock chart by default, but traders can estimate them by looking at historical data and anticipating the high and low points of a given asset’s price range. Next, they’ll need to determine an appropriate target price by subtracting the current price from the previous price. Finally, they must take the product of this calculation and a Fibonacci ratio or percentage, and either subtract or add this new number to the high or low price, respectively, to determine the direction of the trend.

The most popular ratios are 23,6, 38,2, and 61,8. Traders use the following formula to determine the levels based on the historical performance of an asset’s price on the financial market:

To calculate the Fibonacci retracement of an upward trend, one must take the maximum swing and subtract the Fibonacci proportion of the difference between the maximum and minimum swings.

Retracement in a falling trend = Low Swing + ((High Swing – Low Swing) Fibonacci percentage).

Fibonacci Retracement Strategy

As a part of a trend-trading strategy, Fibonacci retracement levels are frequently implemented. Traders in this situation look for retracement inside a trend and attempt to enter low-risk trades in the direction of the original trend utilizing Fibonacci levels. This Fibonacci retracement strategy is based on the belief that prices tend to rebound in the direction of the prevailing trend after testing key support and resistance levels identified by Fibonacci retracement levels. Here are some of the Fibonacci retracement strategies you can use while trading:

#1. Adjustments in the Context of Construction

Traders who are just starting out often struggle with the task of providing background for their transactions. By identifying the market circumstances necessary to trade that pattern or signal, you apply context. The definition of a trading strategy is when you start constructing a framework around your setups.

Before the market predicts support and resistance, you must utilize the retracement method daily.

Now, this doesn’t mean you are going to go long or short at these levels without doing some serious thinking. Basically, it implies that if a nice setup presents itself at one of these levels, you take it with the understanding that there’s a good chance it will result in a significant reversal, and It’ll be more willing to accept a sizable profit.

#2. ABCD Patterns

The “AB” and “CD” legs of an ABCD pattern are both the same distance apart. Traders employ harmonic patterns to identify potential points of reversal and to take profits when they are there.

The CD leg is an extension of the 100% false AB leg beginning at point C. As soon as you begin looking for them, you will notice that they are present all the time in whichever market you choose to trade in.

#3. Taking Measures

As a scalper, You rarely enter trades with a large magnitude. Typically, I will take a large initial position and then trade around it, selling off portions of my holdings when the market rises in my favor and buying them back at lower prices.

Backtesting is a great way to get information about how well one of your strategies scales, and Fibonacci retracement levels are a great place to start. You would set the bar at 50% initially and, for more powerful movements, at 38.2%.

#4. 50% Retracements

The best for last, as they say. You will be able to put this entire Fibonacci retracement trading strategy to the test once you have gained sufficient knowledge. Despite the fact that most people never used this strategy in their own trading, But have known several traders who have been quite successful using strategies very similar to this one.

What Is the Best Retracement Indicator?

For optimal performance, use the Fibonacci retracement indicator for a larger, multi-indicator trading strategy. Incorporate the retracement with other technical indicators and price action levels, including candlestick patterns, oscillators, moving averages, the relative strength index (RSI), and more.

Where Should I Draw Fibonacci Retracement?

One should begin at the peak of the swing and work one’s way down to the trough. Your Fibonacci retracement tool will automatically generate the appropriate Fibonacci levels when you input these two points.

Fibonacci Retracement vs Extension

In the same way that Fibonacci retracement levels can assist traders in locating entry (or exit) points in the hope of catching the resumption of an initial trend, Fibonacci extension can supplement this strategy by providing traders with profit targets that are based on Fibonacci or by estimating how far a price may travel after a pullback has been completed.

A Fibonacci retracement is often used to create a case for initiating a trade, but a Fibonacci extension is typically used to determine where to withdraw profits from a trade. This is the primary distinction between a Fibonacci retracement and an extension.

What Are the Pros and Cons of Fibonacci Retracement?

The use of Fibonacci Retracements has a number of advantages:

- It assists market participants in determining the support and resistance levels that serve as indicators of possible market developments.

- Provided market participants with the ability to determine the optimal timing to open or close a position in the market

- You are able to build levels in the stock’s chart between any two prices by drawing retracement levels between them. These levels allow you to discover price signals between the prices at which they were made.

- Day traders, swing traders, technical traders, and long-term traders can all benefit from this indication.

Using Fibonacci Retracements Can Have Its Drawbacks –

- Despite the fact that retracement levels offer traders levels of support and resistance, there is no assurance that prices will stop climbing or decreasing when they reach those levels.

- Because there are so many different retracement levels, it can be difficult for traders to determine which one is the optimal one to use that would result in a profit for them.

- Because of the fact that this particular signal is rather difficult to comprehend, not all stock market traders are able to make appropriate use of it.

Is Fibonacci Retracement Good for Day Trading?

Yes, fibonacci retracement is good for morden day trading. If you’re into day trading, you need to be familiar with the Fibonacci retracement tool. One can use it to find turning and extending spots. Although the Fibonacci retracement sequence and strategy can be challenging to grasp, the calculator itself is not too complicated.

Conclusion

In technical analysis, Fibonacci retracement is frequently employed to determine when a correction or counter-trend bounce has run its course. When prices correct or reverse direction, they frequently retrace some of the prior trends. The range from 38.2-61.8 percent (with 50% in the middle) encompasses more outcomes than brief 23.6% retracements. However, this area is only a reverse alert zone, despite its apparent size. For a reversal to be confirmed, additional technical signals are required. To verify a reversal, use candlesticks, momentum indicators, volume, or chart patterns. Indeed, the stronger the signal, the more corroborating evidence there is.

Fibonacci Retracement FAQs

What is the Fibonacci golden ratio?

A golden ratio is an irrational number that is equal to (1+√5)/2, or approximately 1.618.

How do I trade with Fibonacci retracement and extension levels?

After learning the formula for Fibonacci retracement and how to interpret its results, you can do the following:

- You can use them to limit your exposure to a loss when going long or short on an asset

- You can use the Fibonacci extension values to pinpoint entry and exit points for buy and sell orders

- Take profits before the tool’s prices since a rally may not reach the price targets.

Which is the most disadvantage of the Fibonacci method?

The Fibonacci method’s biggest downside may be traders’ inability to understand its outcomes. As a result, investors shouldn’t treat the Fibonacci levels as hard and fast levels of support and resistance.

Similar Posts

- Forex Trading 101 – How To Have A Good Foundation For Your Trading

- PRODUCT MANAGER SKILLS: Top Product Manager Skills

- MARKETING TRENDS in 2023: What You Should Know!! (Detailed)

- The Top Must-Have TECHNICAL SKILLS FOR RESUME With Examples

- BEST PLACES TO LIVE IN MONTANA: All You Need to Know