Capital budgeting is one of the processes of deciding which long-term capital expenditures are worth a company’s money based on their ability to benefit the company in the long run.

Learn more about the importance of capital budgeting in business and also how to use the techniques in decision-making.

What is Capital Budgeting?

Capital budgeting is a series of techniques or processes for deciding when to invest in projects. For example, one can use capital budgeting techniques to evaluate a potential investment in a new factory, manufacturing line, or computer system. Basically, capital Budgeting is a decision-making technique in which an organization prepares and decides any long-term investment whose cash flow returns are expected to be earned beyond a year. Generally, an organization can make any of the following investment decisions:

- Expansion

- Purchasing

- Substitute

- Brand-new Product

- R&D

- Significant Publicity Campaign

- Investment in social welfare

Capital Budgeting Decision Analysis

The capital budgeting decision-making process basis is on determining if the projects and expenditure areas are worth financing in cash from the company’s capitalization framework of debt, equity, and earnings – or not.

Techniques for Capital Budgeting Decision Analysis

The following are the five main techniques or processes one can use for capital budgeting decision analysis in order to choose the viable investment:

#1. Payback Period

The payback period is the number of years it takes to recover the original expense of the investment – the cash outflow. So, this is to say that the faster the payback period, the better.

Specifications:

- Provides a rough estimate of liquidity.

- Provides some details about the investment’s risk.

- The calculation is easy.

#2. Discounted Payback Period

This is one of the most important cash budgeting techniques.

Specifications:

- It takes into account the time value of capital.

- Using the cost of money considers the risk in the project cash flows.

#3. Net Present Value

The net present value (NPV) as a cash budgeting technique is the amount of the present values of all projected cash flows in the event that a project is undertaken.

NPV = CF0 + CF1/(1+k)1+ . . . + CFn/(1+k)n

where,

- CF0 = Initial Investment

- CFn = AfterTax Cash Flow

- K = Required Rate of Return

The required rate of return is typically the Weight Average Cost of Capital (WACC) – which includes both debt and equity rates as the total capital.

Specifications:

- It takes into account the time value of capital.

- Takes into account all of the project’s cash flows

- Using the cost of money considers the risk in the project cash flows.

- Indicates whether the investment will increase the value of the project or the business.

#4. Internal Rate of Return (IRR)

The IRR as a cash budgeting technique is the discount rate applied when the present value of the projected incremental cash inflows equals the project’s initial expense.

Specifically, when PV(Inflows) = PV (Outflows)

Specifications:

- It takes into account the time value of capital.

- Takes into account all of the project’s cash flows

- Using the cost of money considers the risk in the project cash flows.

- Indicates whether the investment will increase the value of the project or the business.

#5. Profitability Index

The Profitability Index as a cash budgeting technique calculation is by dividing the Present Value of a Project’s potential cash flows by the initial cash outlay.

PI = PV of Future Cash Flow / CF0

So, in which case,

The initial investment is CF0.

They often refer to this ratio as the Profit Investment Ratio (PIR) or the Value Investment Ratio (VIR).

Specifications:

- It takes into account the time value of capital.

- Takes into account all of the project’s cash flows

- Using the cost of money considers the risk in the project cash flows.

- Indicates whether the investment will increase the value of the project or the business.

- When capital is scarce, it is useful for ranking and also in selecting ventures.

Cash Budgeting Examples

Cash Budgeting Example #1

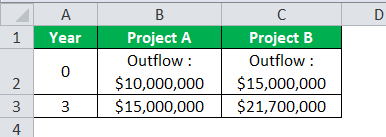

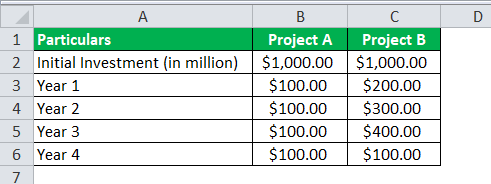

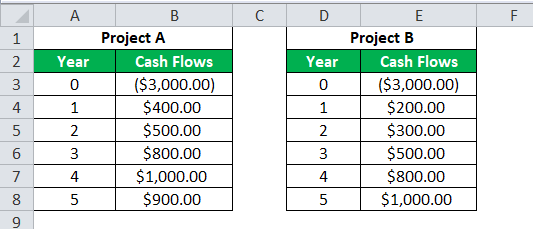

An organization is considering two projects before deciding on one. The following are the predicted cash flows.

The company’s WACC is 10%.

Solution:

So, using the more traditional capital budgeting decision methods, let us compute and determine which project will be chosen over the other.

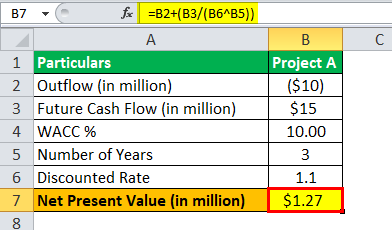

The net present value (NPV) of Project A is $1.27.

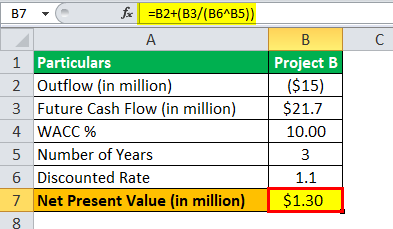

The net present value (NPV) Project B is $1.30.

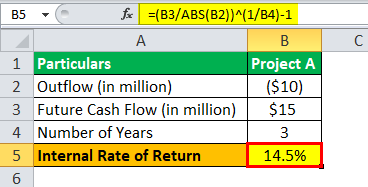

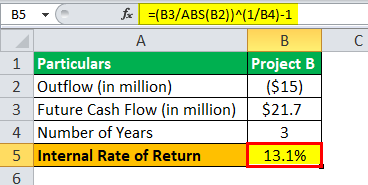

Project A’s internal rate of return is 14.5%.

Project B’s internal rate of return is 13.1%.

Since the net present value for both ventures is so similar, making a decision here is difficult. As a result, we choose the following approach to determine the rate of return on investment in each of the two ventures.

This now indicates that Project A would generate higher returns (14.5 percent) than Project B, which is producing decent but lower returns than Project A.

As a result, we can choose Project A over Project B.

Cash Budgeting Examples #2

When choosing a project based on the Payback period, we must consider the inflows each year and the year in which the outflow is offset by the inflows.

There are now two approaches for calculating the payback duration based on cash inflows that can be even or different.

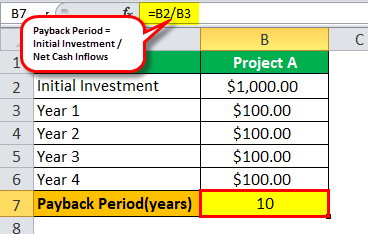

Project A’s payback period

After ten years, the inflow has remained constant at $100 million.

Since Project A represents a constant cash flow, the payback period is a measure of Initial Investment / Net Cash Inflow. As a result, it will take roughly ten years to complete Project A to recover the initial investment.

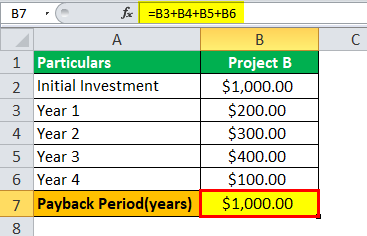

Project B’s payback period

Adding in the inflows, the $1000 million investment is covered in four years.

Project B, on the other hand, has erratic cash flows. If you add up the yearly inflows, you can easily determine which year the investment and returns are near. As a result, the initial investment criteria for Project B is met in the fourth year.

In comparison, Project A takes longer to produce any benefits for the entire enterprise, so Project B should be chosen over Project A.

Cash Budgeting Example #3

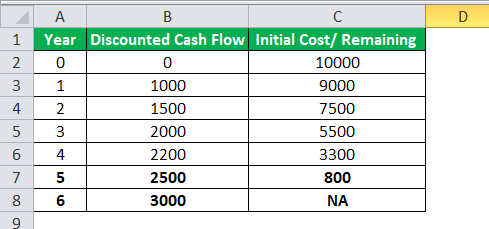

Consider a project with a $100,000 initial investment. Using the Discounted Payback Period process, so we can determine whether or not the project range is worthwhile.

This is an extended type of payback period in which the time value of money is considered. Also, one can use the discounted cash flows to calculate the number of years needed to satisfy the initial investment.

Given the observations below:

Certain cash inflows have occurred over the years as a result of the same initiative. We compute the discounted cash flows at a fixed discount rate using the time value of money. The discounted cash flows are shown in column C above, and column D shows the initial outflow that is offset each year by the projected discount cash inflows.

The payback period will be between years 5 and 6. Now, because the project’s life is seen to be 6 years, and the project returns in a shorter period, we can infer that this project has a better NPV. As a result, selecting this project, which has the potential to add value to the business, will be a wise decision.

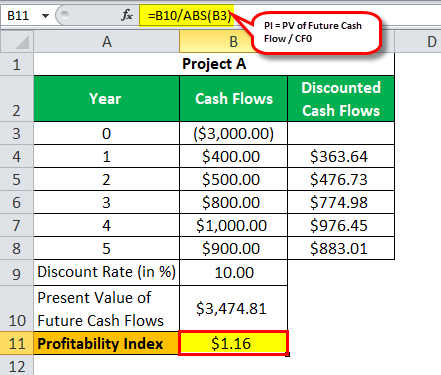

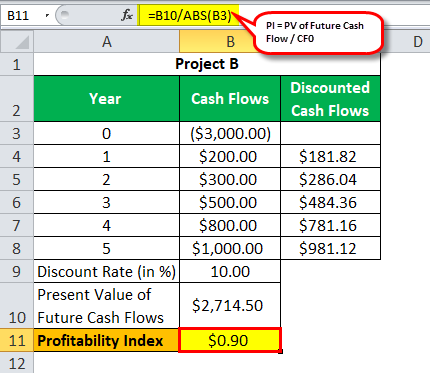

Cash Budgeting Example #4

Using the Profitability Index budgeting method to choose between two projects that are tentative with a given business. The following are the expected cash inflows from the two projects:

The Project A Profitability Index is $1.16.

Project B’s profitability index is $0.90.

The profitability index also includes converting the business’s daily predicted future cash inflows using a discount rate, which is usually the WACC percent. The number of these present values of potential cash inflows is compared to the initial expenditure to calculate the profitability index.

If the Profitability index is greater than one, it indicates that inflows are more beneficial than outflows.

In this case, Project A has an index of $1.16 compared to Project B, which has an index of $0.90, indicating that Project A is clearly a better option than Project B and is thus chosen.

Benefits of Capital Budgeting

- It aids in the decision-making process when it comes to investment opportunities.

- Control over the company’s expenditures is adequate.

- Promotes an understanding of risks and their implications for business.

- Increase the wealth of shareholders and improve market holdings

- Avoid over or underinvestment.

Constraints of Capital Budgeting

- Decisions are made for a long time and, as a result, are not usually reversible.

- Because of the subjective risk and discounting factor, the nature of the introspection is introspective.

- Few techniques or calculations are based on assumptions; therefore, uncertainty may result in incorrect application.

Methods of Capital Budgeting: An Overview

- A discounted payback period takes into account the time worth of money but does not account for cash flow.

- It disregards all cash flow although its payback time is straightforward and quick.

- The internal rate of return (IRR) is a single metric (return), but it has the potential to be misleading.

- Net present value (NPV) is a financially solid method of ranking projects across several categories.

How can organizations effectively communicate the results of their capital budgeting analysis?

Organizations can effectively communicate the results of their capital budgeting analysis by presenting clear, concise, and well-organized data and analysis, and by making sure that the results are easy for stakeholders to understand.

What role do financial projections play in capital budgeting?

Financial projections play a crucial role in capital budgeting, as they provide the data and analysis needed to evaluate the potential financial outcomes of different investment options.

What factors should organizations consider when making capital budgeting decisions?

Organizations should consider a wide range of factors when making capital budgeting decisions, including the potential risks and rewards of each investment, the availability of financial resources, the organization’s goals and objectives, and the impact of each investment on the organization’s financial and operational performance.

How can organizations ensure that their capital budgeting decisions align with their overall business strategy?

Organizations can ensure that their capital budgeting decisions align with their overall business strategy by considering their goals and objectives, and by involving key stakeholders in the capital budgeting process.

What role do stakeholders play in capital budgeting?

Stakeholders play a critical role in capital budgeting, as their input and feedback can help organizations make better investment decisions, and can ensure that the results of the capital budgeting analysis are well-received and effectively communicated.

Conclusion

Capital budgeting is an integral and critical process for an organization to select between projects in the long run. It is a protocol that must be followed before investing in any long-term project or company. It provides management with methods for properly calculating returns on investment and also making measured judgments to understand whether the selection will be advantageous for increasing the company’s value in the long run or not.

Capital Budgeting FAQs

What is capital budgeting and why is it important?

Capital budgeting is important because it creates accountability and measurability. … The capital budgeting process is a measurable way for businesses to determine the long-term economic and financial profitability of any investment project. A capital budgeting decision is both a financial commitment and an investment.

What is capital budgeting formula?

The capital cost factors in the cash flow during the entire lifespan of the product and the risks associated with such a cash flow. Then, the capital cost is calculated with the help of an estimate. Formula: Net Present Value (NPV) = Rt.

Which is first in capital budgeting?

Project Generation

Generating a proposal for investment is the first step in the capital budgeting process.

Why is NPV the best capital budgeting method?

Each year’s cash flow can be discounted separately from the others making NPV the better method. The NPV can be used to determine whether an investment such as a project, merger, or acquisition will add value to a company.

- FINANCIAL ACCOUNTING: Best practices and Detailed Guide (+free courses)

- PROJECT FINANCE: Simple Guide to Kick start any Project(+ best picks)

- VIRTUAL ASSISTANT BUSINESS: 2023 Detailed Start-Up Guide (+ Free Tips)

- Mutual Funds vs Index Funds vs ETFs: Understanding the differences

- INCREMENTAL CASH FLOW: Meaning, Calculations, Importance, And Limitations

- ETFs vs Index Funds: The Best Option for Beginners and Pros