Moving from zero to million is the hardest challenge among crypto investors and traders so far. They would normally exhaust all possible strategies to earn from lucrative trading with other users around the world. This network is becoming even more competitive as the industry evolves and expands constantly.

Over a decade past, it has reached over $2 trillion in overall market cap. What’s more enticing is that various businesses and financial institutions have begun adopting the new currency into their operation, mainly to streamline the process. It simply means more opportunities are on the grab for many people across the globe.

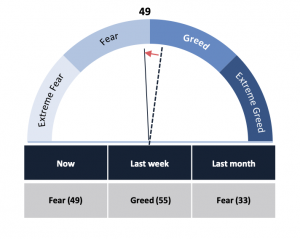

But beyond the aspirations of investors to succeed in the crypto market, there are challenges embedded in the system. For instance, market sentiment is one factor that affects price movements. It’s one aspect that could be hard to decipher among traders because it takes into account internal and external factors.

Evaluating such a driving force would generally require knowing the psychological state of the investors and traders. Without indicators to look at, players would become clueless and blind as to what steps to take. Gladly, there are some resources that could serve as your guide on this matter. Some of them are provided below for you to delve deeper into the underlying forces of the crypto industry.

Understanding Market Psychology

Market psychology is used to describe the overall sentiment that steers the market trends and price movements. This has an underlying assumption that human beings are greatly influenced by cognitive and emotional biases and, therefore, subject to such phenomena as herd instinct. All of these things suggest that markets are not efficient engines of rationality as claimed by mainstream economics.

There are technical indicators that can determine the current psychological state of the market. For instance, a trading strategy may identify opportunities through historical price and volume trends. A good grasp of crowd behavior is deemed important to know how such indicators influence the market. However, predicting the market psychology is hard, especially the one that’s highly speculative in nature. Yet, looking at the following indicators might be of great help to aid crypto investors in judging the market psychology. If you want to become a trader yourself, beginner-friendly crypto trading platforms are advisable to use as a start. Such a regulated platform is Bitcoin Era App.

Open Interest in the Market

This has something to do with the total number of derivatives contracts that have been settled for an asset. It provides an accurate picture of the trading activity and whether the money that flows into the market is increasing or decreasing. Currently, this plays a major role in determining crowd psychology. The rise and fall of open interest are dependent upon the creation or destruction of a new contract. But generally, it only matters when it deviates from the norm.

Open interest is also known to reflect the market psychology through the market’s inherent tendencies of bulls and bears. Whether it goes up or down depends on the bulls and bears, which must be equally confident in their existing position. A rising open interest means that bulls are stable to enter into contracts with bears. One group of participants may lose, but as long as potential losers enter contracts, the rising trend will continue.

On-balance Volume of Assets

It refers to the running total that rises and falls every trading day based on whether the price is higher or lower than the previous period. The higher on-balance volume means that the bulls are significant, and the bears are weak. An opposite pattern exists when the OBV is low. Another scenario is when this indicator shows a signal that differs from the actual prices. That means that the volume or market sentiment is not consistent with the consensus of value, which implies a looming shift in price.

Generally, when the market volume is high, those traders losing money in their positions can feel the huge impact of their losses. To secure their funds, they may close their positions at a loss. As investors decide to exit the market, the trend established on high volume may not last long. On the other hand, the trend that is based on moderate volume can exist for a longer period since the small losses can accumulate over time to become substantial losses. Experts say that the longest trends may be driven by markets that are changing moderately or moving upward or downward day after day.

Accumulation and Distribution of Assets

When it comes to market volume, accumulation/distribution is also a leading indicator. A positive A/D means that the prices were higher when they closed than when they opened. While a negative one signifies the opposite scenario. The importance of this indicator is best observed in the insight that it provides for the distinct groups of amateur and professional traders. Normally, amateur traders have a greater influence on the market’s opening price as they usually base their initial trades on the financial news and recent updates.

On the other hand, professional traders have the habit of determining the day’s ultimate outcomes. When these players disagree with the amateur’s stand at the open, they will drive the prices lower for the close. Otherwise, they would decide to push the price higher all day and into the close. For future trends, the performance of professionals is considered more important than the activities of amateur participants.

How to Analyse the Prevailing Market Psychology

Using technical analysis with indicators discussed above, you can look at price charts to find patterns that suggest trends and reversals. Many experts believe that such patterns are the result of market psychology. The chart is used would generally provide representations of emotions, such as greed, fear, optimism, and even herd instinct. This tool can illustrate how market participants are likely to react to future expectations.

The Bigger Picture

Applying the principles of market psychology in cryptocurrency investing and trading may be helpful for various ends. Investors have to be clever in the process because this platform remains highly speculative and unpredictable. Usually, it’s not about the “one strategy fits all” situation because the industry is subject to ongoing trends and developments. And whether or not your biases can work to your advantage depends on your awareness of them and ways of controlling them. Remember, you’re human, and it’s normal to act like one. But this business may require you to set aside your human nature to succeed.

Why Is Crypto Market Collapsing?

The collapse of one of the world’s largest cryptocurrency exchanges, FTX, is the primary cause of the crypto market decline. The collapse of FTX and its dispute with Binance has not only caused a massive sell-off in the market, but it has also limited liquidity in the crypto market.

What is Trading Psychology?

Trading psychology refers to a trader’s emotional and mental condition, which influences their trading decisions. It indicates a trader’s mental state, which drives trading decisions and determines success.

What Are the Practical Steps in Mastering Your Trading Psychology?

#1. Have the right tradng attitude

Always keep in mind that the market is not continuous. You will have good and bad days—they will come and go. Also, keep in mind that you will not make a fortune overnight; developing a great portfolio takes time and effort.

#2. Have the right trading strategy

Many activities take place in the cryptocurrency market, and you will need a set of guidelines to guide you. Your rules should specify the kind of trades you want to make and the times you want to make them.

These criteria may also include the maximum number of wins or losses you may tolerate in a single day. Aside from that, you must have a realistic stop loss and take profit, an acceptable risk-to-reward ratio, and a solid entry and exit strategy. You must also be aware of the key things to avoid.

When you’ve reached any of your boundaries, you must quit trading regardless of what the market throws at you.

Take your time developing a trading strategy that is unaffected by market emotion. You can learn from successful traders by observing what they do. Do not imitate them; instead, stick to your tried-and-true strategy.

#3. Use automated trading strategy

You can utilize automated bots if you do not want to go through the process of learning how to trade. These bots are programs that trade on your behalf. Trading bots make decisions based on market conditions and are not impacted by emotion. Fear, greed, or doubt have no effect on them.

#4. Have trading breaks

The market is open 24 hours a day, but sitting in front of it for so long does not help. It would simply lead to burnout and the temptation to gamble or make emotional decisions. Take regular trading breaks or limit the number of hours you trade per day.

#5. Maintain disipline

Once you’ve devised a strategy, adhere to it no matter what. A sloppy trader believes rumors and opinions. This trader does not have a trading strategy. Indiscipline in trading merely invites distinct trading emotions that will cause you to continue losing money.

Final Thoughts!

The crypto market has its own sentiments, too. Like other financial industries, the perception and reaction of general users can impact the price movements of the assets. If the investor or trader is unaware of these things, earning profits might be harder than losing money. It’s always helpful to go back to the fundamentals and incorporate the concepts with the technical indicators as a reference for your investment decisions.