If you want to limit risk when first acquiring shares of stock, all you need is a protective put. Protective put strategy is a crucial topic in the world of business and options strategy. Risk is unavoidable in today’s business world. However, it can be managed. One of the risk management and option strategies commonly used is the protective put. This article will throw more light on what is a protective put option. We will also discuss more on protective put and covered put. Also, we will guide you on protective put with covered call.

Like me, I know you do not like stress. I will try as much as possible not bore you with unnecessary information to avoid information overload. So let’s get straight to the point by looking at what is a protective put. Shall we?

What Is A Protective Put?

A protective put is a risk-management strategy that investors use to secure the loss of owning a stock or asset. The hedging strategy requires an investor to buy a put option for a fee, called a premium.

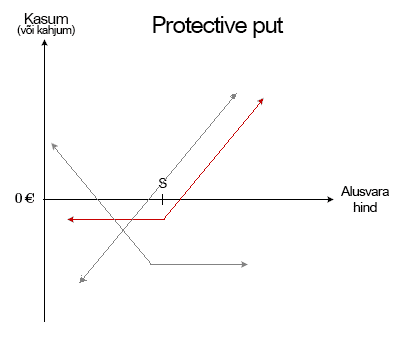

Additionally, a protective put is a risk management and options strategy. It entails holding a long position in the underlying asset like stocks and purchasing a put option with a strike price equal or close to the current price of the stock. A protective put strategy is also called a synthetic call.

In fact, a protective put strategy is similar to the nature of insurance. Its main goal is to narrow potential losses that may result from an unforeseen price drop of the underlying asset.

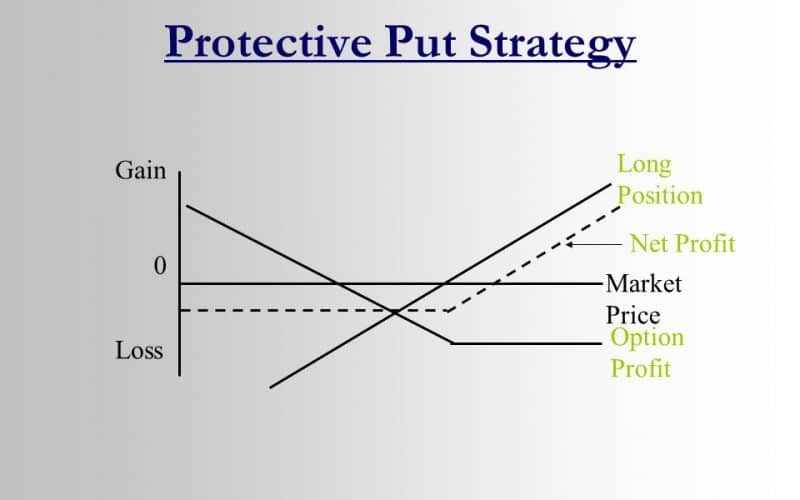

However, adopting this strategy does not put an infinite limit on the potential profits of the investor. Profits from the tactics are determined by the growth potential of the underlying asset. On the other hand, a portion of the profits is reduced by the premium paid for the put. Protective puts may be set on stocks, currencies, commodities, and indexes and give some shield to the downside.

Protective Put Strategy

Indeed, management has its strategies and course of action (planning, organizing, directing, and controlling). Likewise A protective put. What do you think are the strategies of the protective put?

Protective puts are generally used when an investor is long or purchases shares of stock or other assets that they plan to hold in their portfolio. Basically, an investor who owns stock has the risk of taking a loss on the investment if the stock price wanes below the purchase price. By purchasing a put option, any losses on the stock are reduced.

The protective put places a known floor price below which the investor will not continue to lose any added money. Even as the underlying asset’s price continues to fall.

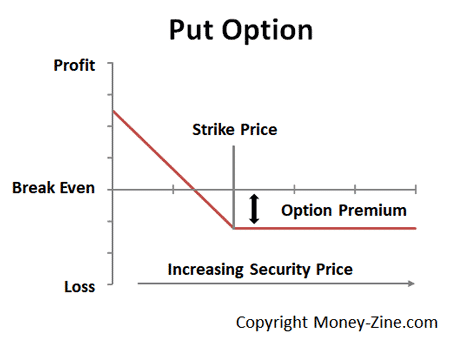

Nevertheless, a put option is a contract that gives the owner the right to sell a particular amount of the underlying security at a set price before or by a specified date. Unlike futures contracts, the options contract does not restrain the holder to sell the asset. It allows them to sell if they should choose to do so.

The set price of the contract is called the strike price, and the specified date is the expiration date.

Protective Put Option

Purchasing a protective put provides you the liberty to sell a stock you already own at the strike price. Protective puts are helpful when your outlook is bullish but you want to protect the value of stocks in your portfolio in the event of a downturn. Also, it helps you cut back on your antacid intake in times of market uncertainty.

Truly, protective puts are often used as an option to stop orders. The problem with stop orders is they sometimes operate when you don’t want them to operate. However, when you really need them they don’t work at all. For example, if a stock’s price is fluctuating but not really tanking, a stop order might get you out early.

If that happens, you apparently won’t be too happy if the stock bounces back. Or, if a major news event happens overnight and the stock gaps down significantly on the open, you might not get out at your stop price. Instead, you’ll get out at the next available market price, which could be much lower.

If you buy a protective put, you have total control over when you use your option, and the price you’re going to receive for your stock is planned. However, these benefits do come at a cost. Whereas a stop order is free, you’ll have to pay to buy a put. So it would be helpful if the stock goes up at least just to cover the premium paid for the put.

Now let us discuss briefly on protective put with covered call.

Protective Put With Covered Call

Both of them are trading options, so it can be forgiven when newbies confuse protective put with a covered call. As mentioned earlier in our introduction, one of the objectives of this article is to show you the difference between them.

So let’s get to it.

Strategy:

A Covered Call is a basic options trading strategy usually used by investors to protect their huge shareholdings. It is a strategy in which traders own shares of a company and Sell the OTM Call Option of the company in a similar proportion.

However, the Protective Call strategy is a hedging strategy. In this strategy, a trader shorts position in the underlying asset (sell shares or sell futures) and buys an ATM Call Option to cover against the rise in the price of the underlying.

When To Use

The Protective Call option strategy is applied when investors are bearish in market view and want to short shares to benefit from it. On the other hand, the covered call option works well when investors have a mildly Bullish market view and expect the price holdings to moderately rise in the future.

Risk

For the protective put, the maximum loss is restricted to the premium paid for buying the Call option. It occurs when the price of the underlying is lesser than the strike price of a Call Option.

However, for covered calls, the maximum loss is unlimited. It depends on how much the price of the underlying falls. Loss happens when the price of the underlying goes below the purchase price of the underlying.

Reward

The maximum profit is unlimited in the protective put strategy. The profit is dependent on the sale price of the underlying. While for covered calls, investors earn a premium for selling a call. Maximum profit occurs when the purchase price of underlying moves above the strike price of a Call Option.

(Free Tip) Advantage and Disadvantage Of Protective Put

An advantage of a protective put is that it minimizes the risk when entering into a short position while keeping the profit potential limited.

However, its disadvantage is that the Premium paid for Call Option may eat into your profits.

Example Of Protective Put

Let’s assume you own 1000 shares in WNE Corp, with each share valued at $1000. Believing that the price of your shares will increase in the future. However, you want to hedge against the risk of an unexpected price decline. Hence, you decide to purchase one protective put contract (one put contract contains 1000 shares) with a strike price of $1000. The premium of the protective put is $50.

The payoff from the protective put is dependent on the future price of the company’s shares. The following scenarios are bound to happen:

If the share price goes beyond $1050, you will experience an unrealized gain. The profit can be calculated as Current Share Price – $1050 (it includes initial share price plus put premium). The put will not be exercised.

In this case, the share price will remain the same or slightly rise. However, you will still lose money or hit the breakeven point in the best case. The small loss is caused by the premium you paid for the put contract. Just as to the previous scenario, the put will not be exercised.

In this case, you will exercise the protective put option to limit the losses. After the put is exercised, you will sell your 1000 shares at $1000. Thus, your loss will be limited to the premium paid for the protective put.

Conclusion

In summary, a protective put strategy needs to be fully understood by investors because of its crucial nature. Also, protective put and covered call are not the same.

Protective Put FAQ

Are protective puts worth it?

The cost of the puts should be worth the protection they give you if you want to protect your money. People who buy “protective puts” have the same risk as people who buy other types of puts: If the stock stays above the strike price at the end of the contract, you could lose the whole amount of money you paid.

What is a protective put example?

Let’s assume you own 1000 shares in WNE Corp, with each share valued at $1000. Believing that the price of your shares will increase in the future. However, you want to hedge against the risk of an unexpected price decline. Hence, you decide to purchase one protective put contract (one put contract contains 1000 shares) with a strike price of $1000. The premium of the protective put is $50.