The issuer from which a money order was purchased need not be the same for the person who receives it. It can be cashed at a nearby bank or credit union, but depending on the institution’s policies, the recipient might not get the money all at once. Cashing the money order at the issuer’s office is a fantastic choice if the payee has no bank account. This post will also thoroughly explain all you need to know and how to obtain a money order.

What is a Money Order?

A money order is a document that often enables the named payee to obtain cash on demand. It is typically issued by a government or banking institution. A money order works similarly to check-in; the buyer can stop payment.

People without access to a traditional checking account frequently use money orders because they are widely accepted and easily converted to cash. These items can be purchased from most institutions for a small service fee and are an acceptable repayment method for small personal and business debts.

Where To Get a Money Order

You can buy a money order at any bank or credit union, as well as most grocery stores, convenience stores, and any store that offers check cashing or money services such as MoneyGram or Western Union. The U.S. Postal Service also offers money orders.

You must bring enough cash or a debit card to cover the money order cost to place an order. You might be asked to show your ID and complete a special form for transactions that total more than $3,000. Money laundering is avoided with the help of this information.

How To Use Money Order

When purchasing a money order, the buyer must fill out a form with the recipient’s name and the amount they should receive. The majority of money orders have a $1,000 maximum. As a result, if a buyer requires more than the allotted amount, he must place multiple orders. Because it’s a one-time purchase, you should carefully fill out the money order and keep good records.

The payee’s name, the issuer’s, and the maximum amount that can be cashed are all disclosed to the financial institution or authorized entity that issues the money order to the payer. The fees assessed to the payee are not included in this dollar amount. Consider all expenses when buying money orders. A bank or credit union typically charges more than a convenience store when issuing money orders.

A receipt with the money order’s serial number is provided when a buyer pays for a money order. Always retain this information until the buyer clears the money order. Tracing a money order can be difficult or even impossible without a receipt.

Benefits and Drawbacks of Money Order

Paying with a money order can, in some cases, be safer than paying with a personal check. Since the account holder’s routing and bank account numbers are printed on the bottom of personal checks, this private information can be stolen and used to write and sign fake checks. On the other hand, money orders do not contain private information about the buyer.

On the downside, money orders can be more difficult to track than a personal check. To determine whether a personal check has cleared, check writers only need to visit their bank or look at their online account for information about its status.

How Much is a Money Order?

Although there is an additional cost for issuing a money order, the fee is generally only a small fraction of the value of the order. For example, the USPS charges $1.65 for money orders of up to $500 and $2.20 for orders of up to $1,000. Money orders printed at military post offices have lower fees.

Commercial institutions may charge different amounts for their money orders, although the fees are usually comparable. Money orders sent outside, however, could have greater costs.

Where Can I Get a Money Order?

The first thing you’ll most likely do when you need a money order is search for local money orders. Here are some of the best locations to obtain a money order, many of which are probably close to you.

#1. Sigue

Sigue offers money orders and safe financial transactions through its extensive authorized agent network spread across all 50 states. Authorized Sigue representatives can be found nearby at convenient local merchants and retailers. By visiting Sigue.com, you can locate a location for a licensed Sigue agent. Customers who prefer to manage their finances without a checking account to pay for rent, utility bills, auto payments, and other financial obligations have a great alternative in money orders.

To reduce their risk exposure, bank fees, and hassles from returned items for insufficient funds, landlords and creditors prefer using money orders over personal checks. A money order is inexpensively available from any authorized Sigue location. Money orders do not have an expiration date or require proof of purchase. If the money order is lost and needs to be replaced, please make sure to fill out and keep the stub attached to the money order. To send money to more than 50 countries, locate a Sigue location nearby or download the Sigue App.

#2. Walmart

Given that it is one of America’s largest retailers, there is probably a Walmart issuing money orders close to you. Any Walmart Supercenter or Neighborhood Market will sell money orders. The maximum cost they can charge you is $0.88. However, the exact fee varies by location. Visit your neighborhood Walmart’s Customer Service Desk or Money Services Center to learn more. Locate a Walmart Supercenter in your area.

#3. Federal Postal Service

Another great place to obtain a nearby money order is the US Postal Service. Postal money orders can be purchased or cashed at any post office, and international money orders up to $700 ($500 for El Salvador and Guyana) can also be bought there. Domestic money orders up to $1,000 can be sent or received by the USPS with the following fees: a cost of $1.25 for a money order between $0.01 and $500 and $1.75 for one between $500.01 and $1,000. Locate a US Post Office in your area.

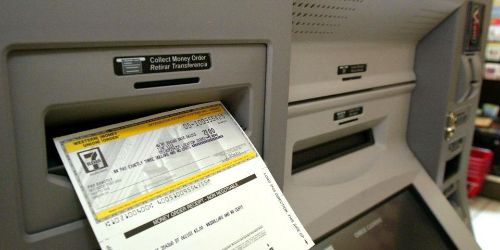

#4. 7-Eleven

7-Eleven is widely distributed across the country and is present in 17 nations. Obtaining a money order is a fantastic alternative, but only up to $1,000. Although there are different fees, you can anticipate paying between one and three percent of the money order’s total value, with a minimum fee of $0.65. Locate a 7-Eleven store close by.

#5. Credit Unions and Banks

Money orders are not always available at banks and credit unions, but some do. Unfortunately, getting a money order through a bank is one of the most expensive options. Depending on the organization, you should plan to spend about $5 to obtain a money order from a bank. Money orders are available from several banks, including Chase Bank, Santander Bank, TD Bank, and Wells Fargo, but we advise calling ahead. To utilize that service, you might need to have an account open with the bank.

Where can I get Money Order for a Free

#1. No-Cost Deposits

If you don’t need cash right away, deposit a check—or a money order—at your bank or credit union for free almost always. Once those funds have cleared in your account, you can use your debit card to make purchases, pay bills online, or withdraw cash from an ATM as you normally would with any other funds in that checking account.

#2. Getting Cash

Money orders may cost you money if you want to cash them. Your bank will likely do it for free, but you might only be able to get the first $200 of the money order (you would then have to wait a few more days, depending on your bank’s policy regarding funds availability—although you can get more on a USPS money order).

Attempting to cash the money order with the one who issued it is another option. For instance, take it to a Western Union store if it is a Western Union money order. Although USPS money orders are free to pay at post offices, there may not be enough cash available. 3 Some other issuers may impose a fee ranging from $3 to $20. 10 And last, money order cashing businesses frequently provide a little fee for cash orders.

Conclusion

Money orders have evolved from their beginnings as a secure method of money transfer during the Civil War to their current status as a practical tool for those without a bank account or a requirement for certified funds. Although money orders are quick and easy, customers might need to compare shops to find the best deals. Remember that money orders are monetary instruments treated the same as cash when you get one. Keep them secure, or withdraw your funds as soon as you can.

Related Articles

- USPS Logo: Meaning and History

- How do Money Orders Work? (+How to Buy with Debit Cards)

- Can I Write a Check to Myself? Simple Steps to Do This Effortlessly!!!

- How to Fill Out a Money Order Correctly: Step-by-Step Guide

- Sales Order Management Software: Top 25 Order Management Software