In today’s world, moving money across borders, particularly inside Africa, has become a need for many people. The demand for smooth cross-border transfers is increasing, whether it is to help family, pay for goods, or invest in a friend’s company. If you’re like me, you’ve probably pondered how to send money from Ghana to Nigeria fast, safely, and at a low cost. With more individuals interacting between Ghana and Nigeria than ever before, understanding the best ways to transfer money is essential.

Why is it important to send money efficiently from Ghana to Nigeria?

Sending money from Ghana to Nigeria involves more than simply a transaction. It’s about bringing people together, creating opportunities, and deepening relationships. Both countries have a considerable economic and cultural impact on one another. According to the World Bank, remittances in Sub-Saharan Africa will reach approximately $48 billion in 2021, with Nigeria and Ghana accounting for a sizable portion of this total. However, transfer costs can range between 6% and 9%, so it is critical to select cost-effective alternatives to prevent losing money in the process.

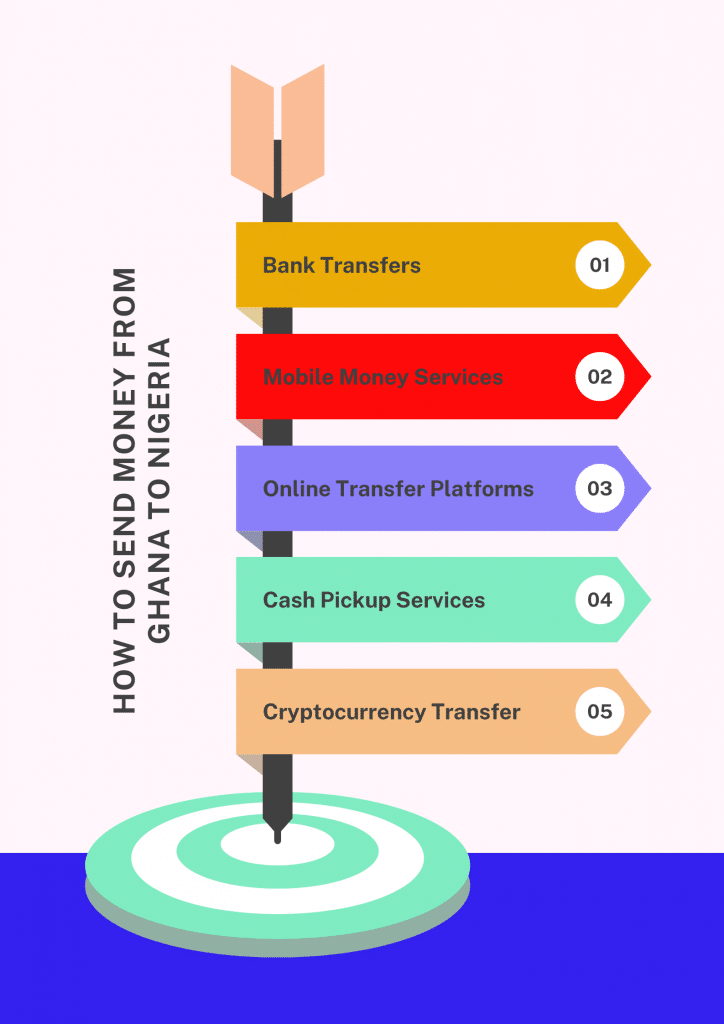

How To Send Money From Ghana To Nigeria

We’ll look at the different ways to send money from Ghana to Nigeria, such as bank transfers, digital wallets, and cash-pickup services. Each strategy has its advantages, and I’ll offer some personal experiences to help you determine which is best for you.

#1. Bank Transfers

Bank transfers are a dependable way to send money from Ghana to Nigeria, especially if you prefer the traditional route. Banks with operations in both countries, such as Ecobank and UBA, facilitate cross-border transactions.

- How It Works: You can make a transfer immediately from a bank branch or through online banking. Before you begin, ensure you have the recipient’s bank account information, including the account number, bank name, and full name as it appears on the account.

- Costs: Bank transfer costs might vary between 5% and 10%, depending on the bank and transfer type. Banks that operate in both countries may offer lower costs and more competitive exchange rates, particularly to repeat customers.

- Processing Time: Bank transfers usually take 2-5 business days. However, events such as public holidays or weekends can cause processing times to be extended, so keep this in mind if you want to deliver on time.

Using a bank that operates in both countries may result in somewhat lower costs and possibly better exchange rates. It’s an easy decision for individuals who have established accounts and access to online banking.

#2. Mobile Money Services

Mobile money has become a widely accessible and popular choice throughout Africa, including Ghana and Nigeria. Services such as MTN Mobile Money, Flutterwave, and Chipper Cash provide quick and inexpensive cross-border transactions.

- How It Works: To use mobile money, connect your mobile wallet to a cross-border platform like Chipper Cash or Flutterwave. This allows you to transfer funds directly from your Ghanaian mobile money account to a Nigerian mobile wallet or bank account.

- Fees: Mobile money transfer fees are typically minimal, ranging from 1-3% of the transaction amount, making it affordable for smaller payments.

- Processing Time: Mobile money transfers are nearly instantaneous, with funds often arriving within minutes, making them a fantastic alternative for quick, convenient transactions.

For those who do not have access to regular banks or who require immediate payments, mobile money offers a dependable, low-cost solution. Mobile money transfers are extremely convenient for sending money to friends and relatives regularly.

#3. Online Transfer Platforms

Online services such as WorldRemit, Wise (previously TransferWise), and Remitly are reliable solutions for cross-border transfers. They frequently provide more competitive exchange rates and cheaper fees than traditional banks.

- How It Works: After creating an account on the desired platform, enter the transfer amount, destination, and recipient’s bank information (or choose cash pickup). Transfers to bank accounts or mobile wallets can also be made directly through platforms such as WorldRemit and Remitly.

- Fees: Online transfer services normally charge fees ranging from 1-5%, with some providing fixed prices for specific transfer amounts or special discounts for first-time users.

- Processing Time: Most online platforms transmit funds within 1-3 business days, although others, such as Wise, provide near-instant transfer choices, particularly to the popular bank and mobile wallet destinations.

These platforms are perfect for consumers looking for competitive exchange rates, security, and convenient choices such as mobile wallets or bank account deposits. Many platforms have a tracking tool that allows you to keep track of the transfer’s status from start to finish.

#4. Cash Pickup Services

Cash pickup services, such as Western Union and MoneyGram, are convenient for recipients without a bank account or mobile wallet. These services enable the client to collect cash at authorized pick-up locations.

- How It Works: Go to a Western Union or MoneyGram agent in Ghana, or start the transfer online. Provide all relevant information, including the recipient’s full name and the pickup location in Nigeria. Once the funds have been delivered, the recipient can collect them at the designated agent location using a valid ID.

- Fees: Cash pickup fees are typically higher than other options, ranging from 7-10% of the transaction amount, making this option best suited for emergencies or occasional transfers.

- Processing Time: Cash pickups are often ready within minutes of processing, giving a quick answer for urgent needs.

Cash pickup services are a dependable option if your receiver requires immediate cash and does not have a bank account or mobile wallet. However, it is preferable to consider this alternative when quick access outweighs the cost, as costs might be much higher.

#5. Cryptocurrency Transfer

For tech-savvy customers, Bitcoin offers a cutting-edge option for cross-border transactions. Platforms such as Binance and Paxful enable users to convert Ghanaian Cedis into a cryptocurrency (such as Bitcoin or USDT) and send it to a Nigerian recipient, who can then swap it for Naira.

- How It Works: Purchase Bitcoin on a platform like Binance, send it to the recipient’s wallet address, and then convert it to local currency using a Nigerian exchange platform.

- Fees: Cryptocurrency transfer fees are typically low, although they vary depending on network congestion and the platform. Additional costs may apply when converting cryptocurrency to local currency.

- Processing Time: Cryptocurrency transfers are almost instant, generally taking only a few minutes depending on the network used.

While this approach can be inexpensive and effective, both parties must grasp cryptocurrency fundamentals and have wallet accounts on trusted platforms.

How to Select the Best Option for Your Needs

When choosing the ideal money transfer option for moving funds from Ghana to Nigeria, it is important to consider cost, convenience, speed, and accessibility. Each issue influences your decision, depending on your priorities and how quickly the funds must arrive. Let’s take a closer look at each component and how to evaluate it:

#1. Fees

When it comes to fees, every dollar matters, especially for repeated transactions. Look for services with competitive prices to increase the amount your beneficiary receives. Some providers, such as WorldRemit and Chipper Cash, have lower transaction fees, making them an affordable option for regular transfers.

- Tip: Compare fee arrangements from various sites. Certain providers charge depending on the amount transmitted, while others may offer flat charges, making them more cost-effective for larger transactions.

#2. Exchange rates

Exchange rates can fluctuate frequently and have a significant impact on how much money the recipient receives in Naira. A slightly improved rate can make a big difference, especially for bigger transfers. While banks may provide more secure transfers, their exchange rates are typically less attractive than those offered by dedicated transfer services such as Wise or Flutterwave.

- Tip: If you don’t need to transmit the funds right away, keep an eye on the exchange rates for a few days. Looking for the greatest deal can help you save money on every transaction.

#3. Transfer Speed

The speed of the transfer can be critical, especially if the money is required immediately. Mobile money providers, including MTN Mobile Money and Chipper Cash, frequently offer near-instant transactions, making them suitable for emergencies. Bank transfers, while reliable, may take 2-5 business days. Cash pickup services such as Western Union and MoneyGram can also provide rapid transfers, although at a greater cost.

- Tip: If your recipient requires funds immediately, prioritize services that provide instant or same-day payments. For less urgent demands, a bank transfer may be more cost-effective, despite the slightly longer wait period.

#4. Accessibility for the Recipient

Consider how easily the receiver can obtain the funds. In Nigeria, where mobile money is widely available, services such as Chipper Cash and MTN MoMo are appropriate for recipients who prefer mobile wallet transfers. If your recipient prefers cash, providers such as MoneyGram and Western Union provide quick cash pick-up services at a variety of agent locations.

- Tip: Ask your recipient whatever manner is most convenient for them. If they do not have a bank account, mobile money or cash pickup solutions may be preferable. If you are using a cash pickup service, ensure that there are accessible pickup sites.

#5. Security and Reliability

The reliability of the platform is critical, especially for cross-border transfers. Choose platforms with a solid reputation for security, such as Wise and WorldRemit, which are regulated and use robust encryption to secure consumers’ financial information.

- Tip: Read user evaluations and ratings to determine the platform’s dependability. Additionally, confirm that the service has received registration and regulation from the appropriate financial authorities in Ghana and Nigeria.

#6. Support Services

A responsive customer support crew can be extremely helpful in the event of an issue. Platforms such as Remitly and WorldRemit provide extensive customer support, guaranteeing that consumers receive assistance when they need it. Look for providers that provide live chat, email, or phone help, as well as the ability to track your transfer status in real time.

- Tip: To ensure your piece of mind, check that the transfer platform includes responsive support channels and an easily available tracking system.

Comparison Template: Use our Money Transfer Comparison Template to analyze prices, transfer speeds, accessibility, and security features across various platforms. This allows you to thoroughly assess each component and select the best option for your specific requirements.

Money Transfer Comparison Template

Common Questions about Sending Money from Ghana to Nigeria.

What is the cheapest way to send money?

Generally, mobile money services and online transfer platforms have the lowest fees. TransferWise and Chipper Cash are typically inexpensive options.

Can I track my transfer?

Yes, most banks, mobile money services, and internet platforms allow you to track the progress of your transfer using their websites or apps.

Are there any limits on how much I may send?

Yes, various services have varying transfer restrictions. For example, mobile money providers may limit daily transactions, whereas banks allow bigger amounts.

What Happens If I Make a Transfer Error?

If you make an error, notify your service provider’s customer support department immediately. Some platforms can correct errors; however, this may cause the transaction to be delayed.

Key Takeaways

- Mobile Money Services: Quick and inexpensive, perfect for near-instant transactions between Ghana and Nigeria.

- Banks and Cash Pickup: Reliable options with actual branches, however they may charge higher costs.

- Online Transfer Platforms: Strike a balance between inexpensive fees and convenient service, while also providing tracking and flexibility.

- Verify Exchange prices: Minor differences can affect the final amount, so check around for the best prices.

- Use Templates for Easy Comparison: Compare fees and benefits across options to make informed decisions.

Conclusion

The availability of many platforms has made it easier to send money from Ghana to Nigeria. Whether you use mobile money, banks, or internet services, the best option will rely on your unique requirements, ranging from urgency to cost efficiency. Understanding each option and following the specified processes will result in a smooth transfer experience. So, what approach will you choose the next time you need to get family or friends across the border?

- 25+ SME GRANTS FOR AFRICANS in 2024 (Updated!!!)

- How to Monetize Your Facebook Page in Nigeria: A Detailed Guide

- Smart Cash Wallet: A Seamless Digital Payment Solution for Nigerians

- Investing in the Nigerian Stock Exchange: A Comprehensive Guide

- Best MTN Data Bundles in Nigeria 2024: A Comprehensive Guide