Searching for a used car is a lot of work, but it may be well worth your time if done right. The best chance of getting a good deal on a car that matches your demands and fits your budget is with the help of online car-shopping tools. The best way to buy a used car online right now in 2023 will be discussed in this blog.

There are numerous reasons to buy used rather than new: You will save money on car insurance, registration, taxes, and depreciation, which is the loss in value of a car over time due to wear and tear. It also makes sense because cars have never been more reliable. It’s not unusual for some properly-maintained vehicles to last well over 200,000 miles.

Yet, in today’s used-car market, where supply is limited and prices are high, you may be unable to discover exactly what you’re searching for at the price you desire. In some cases, buying a new car is less expensive than buying a used one, particularly if you want a late-model vehicle.

Despite these obstacles, here is a summary of the best way to buy a used car online right now in 2023, as well as what to look for when buying a used car from a dealer, a private party, or an online retailer.

Best Way to Buy a Used Car 2023

The best way to buy a used car, truck, or SUV right now in 2023 is described here. Some of these processes are interchangeable, and not all of them are applicable in every circumstance. To plan the right procedure for you, go over the list before you start.

Step 1: Create a budget.

Begin by deciding how much money you want to spend. According to Kelley Blue Book, the average nationwide price for a used car in August 2021 was $25,829. But, the price range in your location may vary greatly.

Look at your finances and determine how much you can afford and how much you’re comfortable investing toward your next vehicle.

Your monthly budget should include both the cost of auto insurance and your car loan payment. Fuel costs, maintenance costs, parking fees, and potential repair costs should all be considered.

Consider your annual percentage rate (APR), insurance premiums, maintenance fees, and taxes as well. It’s easy to focus solely on the vehicle’s sticker price, but including these additional charges should help keep your budget on track.

Step 2: Decide on a car you want.

Choose the type of car you desire by considering how you intend to use it. If you have a long commute or plan to go on long road trips, opt for a car that gets high gas mileage and hasn’t been driven too far. If you have a large family, choose a minivan or large SUV that can comfortably seat everyone.

Many car buyers begin by considering the manufacture of their future vehicles, but this is a decision that should be made later in the process.

Next, prioritize the following elements based on your particular preferences:

- Performance

- Safety

- Reliability

- Styling

- Efficiency

- Capability

- Comfort features

- Fuel economy

Consider your needs and how they might evolve in the future. For example, if you are about to have a baby, a vehicle with four doors and plenty of cargo space may be at the top of your list — while two-door coupes may be instantly ruled out. Choose an SUV or minivan if you require a lot of cargo and passenger space.

Step 3: Do car research.

Once you’ve determined what you want from your vehicle, you may begin looking for manufacturers, models, and years that meet your needs. It’s not a dumb idea to do some general research on car brands, but it’s more efficient to look at the models offered by several automakers that fit your needs.

In addition to comparing factors such as performance, comfort, and style, research aspects unique to used cars such as:

- Current values

- Current owners’ experiences

- Long-term reliability ratings

- Costs of Ownership

- Projected resale values

Make a list of your top three to five car alternatives as you reduce your search, combining related model years if necessary. Finally, using the criteria you’ve created, investigate and compare these vehicles.

Step 4: Start hunting for a car.

The best way to buy a used car involves this enjoyable aspect. Go to showrooms or use your computer to hunt for a specific vehicle that suits your needs.

The most significant elements in identifying the right vehicle are the make, model, age, mileage, and price range you selected previously. If you’re looking online, don’t be overly detailed with your filters; not all dealers enter that information correctly.

Don’t feel obligated to compromise if you don’t instantly find the right vehicle. The majority of online car-buying websites, such as Carvana, Vroom, and CarMax, allow you to save your searches and set up notifications for when new vehicles matching your criteria become available. Likewise, many salespeople will follow up with different vehicles that match your needs if they know you’re still looking.

Adjust your sense of urgency as needed if you have a short deadline. Therefore, don’t give up or settle because your search isn’t instantly fruitful. You may extend your car-buying experience by allowing dealerships and car-buying websites to handle the legwork for you.

Step 5: Examine the car history report.

Remember, you’re buying a used car, and a quick glance at it may not reveal how well the previous owners cared for it. Although the car you’re considering buying may appear to be brand new, it has a history.

Car history records can reveal details about the vehicle’s maintenance history, recall status, registration, and accident history. This information is critical in assessing the car’s true worth.

Even if you don’t want to buy a car that has been in a serious accident, you can use that information to negotiate a lower price. Just keep in mind that if you sell the car, the next buyer may do the same.

Step 6: Take the car for a test drive.

Seeing the car in person before you buy is really beneficial, whether you’re buying from a car dealer or a private party.

Examine the exterior for marks and dents. Examine the interior for stains, tears, and odors. Get inside to familiarize yourself with ergonomics and driving posture. Take the vehicle for a test drive with the seller’s permission to see how it runs. Check if the ride is smooth and quiet and that you are at ease behind the wheel.

Consider hiring a third-party mechanic to perform a pre-purchase inspection. Even if the car appears to be in fantastic condition, a mechanic can inspect the engine bay and undercarriage and identify any problems.

Although some vendors may claim to have performed a pre-purchase check, their priority is to sell the car, not to ensure your satisfaction months later.

When buying from a private seller, pre-purchase inspections are increasingly prevalent. An inspection is essential for these purchases because if the vehicle turns out to be a lemon, you may have no recourse. Approach the subject nicely, and use a competent inspector you can trust.

Step 7: Create a financing strategy.

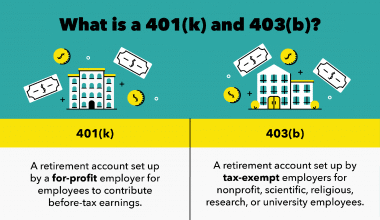

When considering how to finance your vehicle, consider the following:

- How is my credit rating?

- Do I have a trade-in or sufficient funds for a down payment?

- For how long do I wish to pay?

- Should I get pre-approved or use dealer financing?

Used cars are cheaper than new cars, but they still cost thousands of dollars. You may still require an auto loan, either from the dealership or from a private lender. If you buy a used car from a private seller, you’ll almost certainly need to secure your own financing.

When you start car shopping, it’s a good idea to get preapproved by a bank, credit union, or other lenders. Preapproval allows you to search around for cheaper rates – dealer financing doesn’t always give you much wriggle room. Preapproval also allows you to negotiate better rates and terms, as dealer financing is not an option if you buy from a private party.

Step 8: Discuss the pricing.

You should have an idea of what the vehicle is worth and how much you’re willing to pay if you conducted your research early on. To guarantee you’re receiving a decent deal, compare the seller’s price to the average market price.

If you’ve been preapproved for a loan, this is easier because you have a definite limit that the seller must meet if the sale is to go through.

Try to commence talks with an offer that’s low enough to give you some wiggle space but not so low as to disrespect the seller. No matter how badly you desire the car, don’t go above your budget.

if you’re at a dealership focus your talks on the car’s price, not your monthly payment. Although determining your monthly payment will help you understand what you can afford, dealers may simply change your financing to acquire the right monthly payment. This may appear to be alright at the time, but it might lead to significantly more money being spent in the long run.

Step 9: Seal the deal.

Completing a deal at a dealership is very simple because you have a salesperson to assist you. Simply read all of the fine print before signing to verify that you are receiving what you pay for and only paying for what you want.

If you are buying from a private party, ensure that you have the title, a bill of sale, and any other paperwork that your state may require. You must also discuss your payment option with the vendor. This will depend on your financial situation and the desires of the seller – but be careful to prevent scams.

Last but not least, ensure that you are in good standing with your state’s motor vehicle department and that you have at least the bare minimum of car insurance required by law. Almost all states require some type of auto insurance, which helps protect you financially if you cause actual injury or property damage while driving.

Best Way to Buy a Used Car Online

The best way to buy a used car online right now will be discussed in this section. In this post, we’ll focus on buying new or used cars online from dealerships.

#1. Take a test drive before you buy.

Even if you can return the car if you don’t like it, you should try to avoid doing so. Furthermore, you may be debating between rival models and require a test drive to make your choice. Consider borrowing a friend’s car, testing-driving a similar car on a dealer’s lot, or renting a car for a longer period of time.

#2. Shop for your own loan.

Many car dealers provide their own financing, but it’s always a good idea to shop around for a preapproved loan with a few different lenders. This phase will uncover any issues with your credit and provide you with an estimate of the interest rate you’ll have to pay.

#3. Set up an inspection.

You should have scheduled a used-car inspection right away because you’ll only have a limited time to return the car. Begin by assessing your own wear and tear. Afterward, take the car to a mechanic for a complete checkup, where they can place the vehicle on a lift and check for leaks or damage to the underside.

#4. Take a test drive when the vehicle has been delivered.

Drive the car as soon as you arrive if you did not take a pre-purchase test drive. Also, make sure it fits in your garage and is large enough to hold all of your commonly used items. Be advised that the number of miles you can drive before returning the car without incurring a penalty will be limited.

Benefits and Drawbacks of Buying a Used Car

The benefit of purchasing a used vehicle is that they are less expensive than new cars and come in a variety of styles. The best part is that if you examine the vehicle history report, you may buy a used vehicle with confidence. Many first-time car buyers select used cars because they are less expensive and easier to find.

Pros

- Generally cheaper

- A slower rate of depreciation

- Understand what you’re getting yourself into.

Cons

- A higher interest rate if financing is used

- Increased maintenance and repair requirements

- It may be more difficult to locate a certain vehicle.

What is the best payment method for buying a used car?

Bring a cashier’s check, which is more secure than a personal check and ensures that the money is genuinely available, to pay for your vehicle.

What is the most reliable source for buying a used car?

Autotrader leads our list of the best overall used car sites as the most well-known car-buying and selling online auto marketplace. Its large number of listings and powerful search feature make it the preferred site for buying and selling cars.

What is the safest way to buy a used car?

Learn How to Safeguard Yourself While Purchasing a Used Car In 7 Simple Steps:

- Do not forego the test drive.

- Verify the vehicle’s title.

- Be prepared to receive a free vehicle history report.

- But, do not rely solely on that report.

- Examine for Recalls.

- Make contact with the previous owner.

- Have a mechanic inspect your vehicle.

What is the rule of thumb for buying a used car?

The 20/4/10 rule is the cardinal rule of car budgeting. It’s simple: First, you should make a down payment of at least 20%. Second, look for a car that is less than four years old. Most essential, the overall expense of owning the car should not surpass 10% of your pre-tax income.

What should you not say when buying a used car?

Things You Should Never Say to a Dealer:

- “I’m prepared to buy right away.”

- “I can pay this much each month.”

- “I do have a trade-in.”

- “I’m merely paying cash for the car.”

- “I’m not sure.

- Which model do you think I need?”

- “Well, I’ve always wanted one of these.”

- “I’ll go with whatever the most popular selections are.”

What is the 20-4-10 rule cars?

It’s more of a set of principles and a way to budget for vehicle costs. The guideline essentially states that you must make a 20% down payment, sign a four-year loan, and spend no more than 10% of your monthly salary on car expenses.

Conclusion

It does not have to be tough to find the best way to buy a used car. Knowing the procedure, asking the right questions, and conducting research can help you find the right vehicle at a reasonable price. Then, to get the most out of your car and keep its value high, it’s a matter of maintaining it.

Related Articles

- BEST WAY TO BUY A CAR Now!! 9 Practical Cost-Effective Steps in 2023

- HOW TO GET A CAR LOAN: What It Is and What You Should Know

- COMPANY CAR: Uses, Insurance, Leasing, and Guide.

- How To Lower Your Car Insurance Premiums In 2023