The backbone of your firm is inventory. You must keep enough inventory on hand to meet customer demand, but not so much that your storage costs spiral out of control. In this situation, an inventory system may be used. A periodic inventory system or a perpetual inventory system can be used by businesses that sell goods. In this guide, we will explain what a perpetual inventory system is, provide an example, discuss its benefits, and examine the journal entry for periodic and perpetual inventory systems to determine whether it is the best inventory management practice for your small business accounting.

What is Perpetual Inventory?

Perpetual inventory is a continuous accounting practice that records inventory changes in real time, eliminating the need for physical inventory, and ensuring that the book inventory accurately reflects the actual stock. Input devices such as point of sale (POS) systems and scanners are used by warehouses to record perpetual inventory.

Perpetual inventory methods are becoming more popular In warehouses and the retail industry. Overstatements, also known as phantom inventory, and missing inventory understatements can be reduced to a minimum with a perpetual inventory. Companies that use a material requirement planning (MRP) system for production are also required to maintain perpetual inventory.

What is a Perpetual Inventory System?

A perpetual inventory system is based on an accounting method known as perpetual inventory, which continuously records inventory changes in real-time with computerized point-of-sale systems, eliminating the need for physical inventory checks.

Within this system, a company does not make any effort to maintain detailed inventory records of products on hand; rather, purchases of goods are recorded as a debit to the inventory database. A perpetual inventory system differs from a periodic inventory system, in which a company keeps inventory records through regular physical counts.

What is the Periodic Inventory System?

A method used by businesses to account for their products is the periodic inventory system, also known as the noncontinuous system. A periodic inventory does not maintain a continuous tally of goods, purchases, sales, and the costs associated with them based on a specified accounting period.

All purchases are recorded into a purchase account by the company accountant, which is how this system functions. The company counts the physical inventory, and the accountant transfers any remaining balance from the purchases to the inventory account. The accountant then makes the necessary adjustments to the inventory account to reflect the cost of the final inventory.

Also, the physical count of goods is a defining feature of a periodic system. This number is critical because the company does not track unique transactions. This inventory starts the record reconciliation process, whether it is done weekly, monthly, quarterly, or annually.

Understanding Perpetual Inventory Systems

Because they allow for immediate tracking of individual item sales and inventory levels, perpetual inventory systems may be preferable to older periodic inventory systems. Except in cases where it deviates from the physical inventory count due to loss, breakage, or theft, a perpetual inventory does not need to be manually adjusted by the company’s accountants.

Through the use of barcode scanners or other computerized records of the product acquisition, sales, and returns as they occur, system software updates inventory in real-time. A perpetual database that is constantly being updated receives this information.

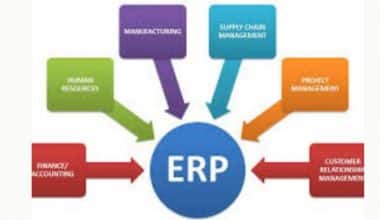

The system enables integration with other departments, such as finance and accounting. This helps to ensure compliance with tax and other regulations. Employees can provide more accurate customer service regarding the availability of products, replacement parts, and other physical components by using perpetual inventory data.

Periodic and Perpetual Inventory System

A perpetual and periodic system requires different tools and procedures for how employees document inventory, although they can be complementary. Employees continuously monitor the products in a perpetual system. Employees only record products at predetermined intervals in a periodic system.

As there are more records for the software and employees to keep track of, a perpetual system is more complex than a periodic system. Muller says, “The fundamentals are the same, regardless of your approach, when considering the system that you want to use. If there is a disconnect within the basic system, even with the most advanced software, you are simply speeding up your mistakes.

You would make system decisions based on the nature of your products, their perishability, and their physical handling, including whether they were large or small and how much space they took up. The nature of the product is also determined by how your company receives and stocks it. “Some goods are unitized: they have small parts and are divided into individual bins.”

The perpetual and periodic systems also differ in the following ways:

#1. Updating your Accounts:

In a perpetual system, updates to the inventory ledger and general ledger are made with each transaction. Updates to the general ledger in a periodic system only occur when there is a physical count, not based on transactions.

#2. Calculating Cost of Goods Sold (COGS):

Under a perpetual system, the software system maintains a running tally of transactions, so it is always able to provide COGS. In a periodic inventory system, COGS is calculated as a lump sum at the end of an accounting period after conducting a physical inventory. Before the end of the accounting period, precise COGS cannot be calculated.

#3. Record Transactions:

A perpetual inventory system requires software because there may be thousands of transactions to track. Software is not necessary for a periodic system, though. You could manually track your inventory in a periodic inventory system.

#4. Cycle Counting:

Cycle counting is the process by which businesses count portions of their inventory to complete a full inventory over a time cycle. They do not count all of their inventory at once but make minor adjustments based on what they count. Businesses use cycle counting only in a perpetual system, also known as sampling. Due to their inability to establish a baseline, they do not use cycle counting in a periodic inventory system.

#5. Keeping Track of Purchases:

Purchases are recorded in either the raw materials inventory account or the merchandise account in a perpetual system. Purchases are logged into the purchases asset account in a periodic system without any unit-count information being added.

#6. Conducting Investigations:

Transactions are available at a very detailed level in a perpetual system. As a result, you can easily conduct investigations into inventory-related errors. Because a periodic system aggregates data at a high level, these investigations are more complicated. It is difficult to use this data to pinpoint process errors.

Even though GAAP standards state that either perpetual or periodic systems are appropriate for any business, each is better suited to a different size of an organization. Because perpetual systems are more time-sensitive, they are generally better suited to companies with high sales volumes or multiple retail locations. Periodic systems may impede decision-making in these organizations. Periodic systems are better suited for companies that do not experience slow inventory updates.

Example of Perpetual Inventory System

The use of wireless barcode scanners in a grocery store is the most common perpetual inventory system example. As soon as a transaction is scanned on the system, it is immediately recorded. Firms can easily calculate the current and required stockpile in this way.

Journal Entry for Perpetual Inventory System

You’ll probably find yourself journalizing transactions when dealing with inventory accounting. To do inventory accounting, you’ll need the most common journal entries listed below.

- Purchase of Merchandise at Cost: Inventory is debited and accounts payable are credited to reflect the purchase of merchandise at cost.

- Payment of AP: The journal entry used to make an invoice payment.

- Credit Terms: Manufacturers and wholesalers typically sell goods on credit. The seller’s bill or invoice contains these credit terms.

- Sale of Merchandise: When a company sells merchandise, two journal entries must be made: one to recognize the sale and another to record the costs of goods sold.

- Collection of AR: Cash collection of accounts receivable is recorded.

The Advantages and Disadvantages of Perpetual Inventory

In comparison to other methods, perpetual inventory allows for more real-time inventory tracking. The system, however, necessitates consistent record-keeping and monitoring and is more expensive to implement than alternative methods.

The following are some ways that perpetual inventory can help you save money:

- There is no need to close facilities regularly to conduct physical inventories.

- Data from scanned barcodes aids in stock forecasting.

- You can account for all transactions, giving your products complete accountability.

Despite being superior, perpetual inventory is not without flaws. There are still ways to lose positive inventory control even though there is a constant, automatic product tracking system.

The disadvantages of using perpetual inventory include the following:

- To keep your data in sync, you must still conduct an annual inventory.

- Every transaction must be entered, which necessitates more consistent record-keeping and monitoring.

- Since they require software and training, perpetual inventory systems are more expensive to set up than other methods.

When to Use a Perpetual Inventory System

When a company needs to know exactly how many units are in stock at all times, a perpetual inventory system should be used. Also, when there are numerous product types in stock and sizable inventory investment, this is especially important. A company would be unable to accurately tell its customers when it would be able to fulfill their orders without a perpetual system.

It is also a useful system for businesses that are growing rapidly since these organizations need to maintain tight control over their working capital investments. Furthermore, any company that has committed to the quick fulfillment of customer orders requires a thorough understanding of its inventory balances, which only a perpetual system can provide.

Who Uses a Perpetual Inventory System?

Perpetual inventory systems are preferred by large companies with massive inventories. For emerging and small to medium-sized businesses looking for scalability, perpetual inventory systems can be ideal.

The cycle counts required for a periodic system are difficult for large corporations to perform.

Furthermore, a company with multiple retail locations may find it easier to control inventory when a product database is regularly updated. For example, a tool retailer may have a customer looking for a rare type of wrench. It has six locations in the neighborhood. It has real-time information about which sites may have one in stock using a perpetual system, so the customer can go get his wrench quickly rather than driving from store to store looking for it.

Other businesses that require perpetual inventory include drop shipping, in which manufacturers ship directly to customers, or trade and distribution.

How to Use a Perpetual Inventory System

Companies must set up a system in which every piece of inventory is entered and deducted as it is sold to calculate the inventory. POS terminals, barcode scanners, and perpetual inventory software must be used to update estimated inventory with each product purchase and sale.

A perpetual inventory system cannot replace a periodic physical inventory because it estimates stock on hand. A physical inventory needs to be performed at some point. Cycle counting, or physically counting a portion of inventory to use as a baseline to check the accuracy of the perpetual system, is commonly used by businesses that use a perpetual inventory system. A full physical inventory will be completed over time.

Metrics to Take into Account When Selecting a System

As you might have guessed from the preceding section, there are arguments for and against perpetual inventory. The viability of each case depends on specific aspects of your company:

#1. Inventory and Transaction Volume

Which of these two approaches is best for you is primarily determined by the amount of inventory you have. For most organizations with large inventories, the benefits of a perpetual inventory system outweigh the drawbacks.

#2. Location Diversity

If your company operates from multiple locations, inventory management becomes extremely difficult. It frequently changes its inventory.

#3. Budget

Your financial situation is undoubtedly the most visible factor. If you can afford to invest in the initial setup costs of a perpetual system, that is.

The infrastructure required to accurately implement this strategy is substantial. It comes at a price that small businesses may not be able to afford.

What is a perpetual inventory system with examples?

Perpetual inventory is a continuous accounting practice that records inventory changes in real-time, eliminating the need for physical inventory, and ensuring that the book inventory accurately reflects the actual stock. Input devices such as point of sale (POS) systems and scanners are used by warehouses to record perpetual inventory.

Does the perpetual inventory system use LIFO or FIFO?

Yes, like first-in, first-out (FIFO), the last-in, first-out (LIFO) method can be used in both perpetual inventory systems and periodic inventory systems.

What are two types of perpetual inventory systems?

- FIFO

- LIFO

- Weighted Average Cost

What is perpetual inventory also known as?

Continuous inventory system

An inventory control system that enables businesses to maintain a real-time inventory account is known as a perpetual inventory system or continuous inventory system.

What is the purpose of the perpetual system?

A perpetual inventory system is a computer program that continuously estimates your inventory based on your electronic records rather than a physical inventory.

Conclusion

Instead of the older, physical-count periodic inventory system, businesses are increasingly using a perpetual inventory system to track inventory. Permanent systems are expensive to implement but less expensive and time-consuming in the long run.

A major disadvantage of perpetual systems is the inability to track lost, damaged, or stolen items, despite the benefits of a constantly updated stock estimate and the interconnectivity of accounting systems. Many businesses counteract this by conducting periodic partial inventory counts, which serve as a baseline for the perpetual system and are intended to provide a full physical inventory by the end of the period.

Related Articles

- Amortization Schedule, Loans, and Calculations

- Accounting Systems: Definitions & Guide To The Best Accounting Software

- SMALL BUSINESS ACCOUNTING SOFTWARE: Meaning, Best Software & Degree

- INVENTORY TRACKER: Meaning, Free Software & Sheet

- INVENTORY TRACKING SYSTEM: Best Practices