“Knowledge is power”, they say. This is especially true for real estate, an industry that has a myriad of risks, which is why it pays to be educated before going into it. There is no better way to do this than by reading and consuming real estate investing books for beginners.

By taking the initiative and teaching yourself, you will be able to familiarize yourself with what real estate is all about before you get over your head. But I know what you’re thinking… there are so many books out there – where do I start?

Well, that’s where I come in, with a recommendation of some of the best real estate investing books for beginners to get you started on your journey.

Key takeaways

Real estate investing is a great way to build wealth, but it is also easy to get in over your head and lose money.

It can be challenging for new investors to get started because there are so many moving parts that they don’t understand or know where to begin.

Many worthwhile books are on the market about real estate investing.

These books delve into the many types of investments and the specifics of each type.

Reading books before venturing into real estate is a great way to familiarize yourself and ensure you don’t run at a loss.

A brief overview of the real estate industry

Real estate is, without a doubt, one of the most lucrative businesses you can venture into. It is a great way to earn passive income while doing other businesses. This is why many people tend to continually go into the world of real estate to enable them to make profitable investments.

However, despite the rewarding nature of real estate, anyone who plans to invest in it must be well-prepared to thoroughly get educated or enlightened about the market before starting. This knowledge will prevent you from running at a loss or failing in the business.

Below is a checklist to help you safely ease into the world of real estate:

How to get into real estate as a beginner

Suppose you are a newbie who is planning to invest in any of the various types of real estate investments like fix and flip, rentals, raw land, online investment, or real estate investment trusts (REITs). In that case, you must endeavor to know the pros and cons of such investment before getting started. Some of the best ways to do this can be through one-on-one mentorship with a real estate expert, learning it in school and being certified as a real estate professional, or reading great books on real estate.

If you choose to go for the latter option of reading real estate books as a beginner, it’s a great choice. However, there are thousands of books on real estate that you will have to choose from, making it a daunting process. That’s why this article is a must-read for you.

15 must-read real estate investing books for beginners

Below, you will find some of the best real estate investing books for beginners recommended by entrepreneurs and investors. These books are vital to success in real estate, as they will form the backbone of your success for years to come.

And the best thing about these books is that they are not just real estate specific; they will also help you develop a winning mindset.

1. “How to Invest in Real Estate: The Ultimate Beginner’s Guide to Getting Started” by Brandon Turner and Josh Dorkin

Topping our list of best books for beginner real estate investors, this book by Brandon Turner and Josh Dorkin gives a great overview of the basics of the real estate investing space. This is a great place to start if you want to get familiar with your options when investing in real estate.

How to Invest in Real Estate doesn’t give you one method — it shows you the multiple paths you can take. Whether that’s flipping, investing as a side hustle or full-on property management, Turner and Dorkin highlight more than 40 different stories from successful, modern real estate investors.

2. “Building Wealth One House at a Time” by John Schaub

If you want to buy your first property, Building Wealth One House at a Time is the best real estate book for beginners. John Schaub walks through how he started with nothing and built an entire portfolio of rental properties. When other investors were buying stocks, Schaub was building up his net worth through real estate.

He emphasizes that novice real estate investors should follow a fundamental strategy for property investing and not succumb to get-rich-quick schemes.

Schaub advocates a slow and steady approach to buying one property at a time.

The book also covers housing market appreciation and how it can impact your real estate portfolio. However, remember that depending on appreciation as a part of your real estate appraisal is a gamble. Appreciation is an unpredictable and difficult-to-depend-on factor.

A common criticism is that it is too basic, but it is one of the best real estate books for beginners. You need to master the fundamentals before embarking on complex strategies.

3. “The Richest Man in Babylon” by George S. Clason

The Richest Man in Babylon is based on Babylonian parables, and it has been hailed as the greatest of all inspirational works on the subject of thrift, financial planning, and personal wealth. The fascinating and informative stories in the book set you on a sure path to prosperity and its accompanying joy.

These are just great stories; it’s not really a how-to book. It’s more of a storybook than anything else, but it is a celebrated bestseller. It often offers an understanding and a solution to most people’s financial problems, whether they know it or not, and identifies what your problems are. The book also reveals the secrets to acquiring money, keeping the money, and making money.

Also, this is the original edition that I’m referring to, not the edited or revised edition for the 21st century. Get the original text.

4. “The ABCs of Real Estate Investing” by Ken McElroy

McElroy’s The ABCs of Real Estate Investing is a must-read for beginners because of its emphasis on knowing the market, negotiating deals and maintaining cash flow. Unlike the first book on the list, The ABCs of Real Estate Investing focuses on larger investments, like apartments, condos, and townhomes.

This book lays out clear strategies for finding these bigger investment properties, including how to effectively team up with other real estate investors to make larger purchases. Once you own them, you need to keep them profitable. Along with teaching you how to find, evaluate, and purchase property, The ABCs of Real Estate Investing also gives you reliable property management tools.

5. “Rich Dad Poor Dad” by Robert Kiyosaki

Rich Dad Poor Dad is one of the most influential books ever written on investing. The book is narrated as a story of growing up with two dads – the poor dad (his birth father) and the rich dad (his best friend’s wealthy father). The poor dad works a full-time job and makes enough money to live on but never invests in assets.

The book explains the difference between assets and liabilities. Assets put money in your pocket, while liabilities take away your hard-earned money. Understanding the simple principle of passive income-producing assets can make you financially independent. It’s not just about having money but also investing your cash flow wisely so that it can generate even more of a return over time!

Kiyosaki tackles how financial literacy is essential. The rich dad encouraged talking about money and business at the dinner table. The poor dad forbade the subject of money to be discussed over a meal.

If you are looking for the best personal finance book of all time that has real estate as its focal point, then this book is a must-read for you! With millions of copies sold worldwide and translated into many languages, the Rich Dad, Poor Dad series has become an all-time finance classic, especially for beginners in real estate.

The other two financial literacy books from Robert in the Rich Dad series are; “Rich Dad’s Cashflow Quadrant: Rich Dad’s Guide to Financial Freedom” and “Rich Dad’s Guide to Investing: What the Rich Invest in, That the Poor and the Middle-Class Do Not.” Reading this trio by Robert will go a long way in helping you manage your finances adequately to create more wealth as you invest in real estate.

6. “The Book on Rental Property Investing” by Brandon Turner

The sixth spot on our list of best books for beginner real estate investors, and the second one by Brandon Turner. It’s no coincidence that the co-founded of The Bigger Pockets podcast and author of multiple best-selling real estate investment books has some prevalence on this list.

The Book on Rental Property Investing gives you four different strategies to start building passive income through real estate. The book covers everything from financing new investments to finding deals and deferring or avoiding taxes. If you want to start investing in rental property, this is a must-read.

7. “What Every Real Estate Investor Needs to Know About Cash Flow” by Frank Gallinelli

If you want to maximize your real estate investments you need to calculate cash flow. In this book, Gallinelli focuses heavily on the numbers. It makes our list of best real estate investing books for beginners because of its focus on math. Whether math is your strength or a challenge for you, Gallinelli lays out how to make it work for you.

This book teaches you the critical measurements you need to make wise investment decisions. Measurements like net present value, discounted cash flow, return on equity, and more will help take you from a beginning investor to a serious pro.

8. “The Book on Investing in Real Estate with No (and Low) Money Down” by Brandon Turner

Real estate investing is about more than buying a house. Often having the money to buy your first property is the barrier to getting started.

Brandon Turner walks you through best practices for using other people’s money to get started investing in real estate! Building on the best real estate books that explain how to invest in property without using your cash, The Book on Investing in Real Estate with No (and Low) Money Down goes a step further to explain how you can use creative financing for your next property.

He tackles everything from FHA loans to hard money loans to owner financing to partnering with others.

If you are willing to put in the sweat equity, there are several ways to invest in real estate with little or no money. Many of these techniques rely on creative financing strategies for real estate. This is, without a doubt, one of the best real estate investing books for beginners.

9. “Buy, Rehab, Rent, Refinance, Repeat” by David M. Greene

Buy, Rehab, Rent, Refinance, Repeat — aka the BRRRR Method — is a real estate investment strategy where you gradually grow your investment portfolio from just one property. This book outlines the details of this plan, outlining how you can make the most of each step.

You can learn how to negotiate sales, what remodels add the most value, when to flip, and how to use your investment property equity.

10. “The Book On Estimating Rehab Costs” by J Scott

If you want to flip homes or rehab a house and turn it into a long-term rental, this book will help you make better decisions about your project’s scope. J Scott, a seasoned house flipper, will guide you through the essentials of getting started. He also includes best practices for building a rehab team, managing contractors, financing options, and much more.

I highly recommend The Book On Estimating Rehab Costs for all real estate investors, even if you are not directly involved with rehabbing a rental property or house flipping. The book helps evaluate the projected profit that real estate investors submit when trying to obtain financing. It is a must-have on your checklist to evaluate crowdfunded real estate deals.

11. “The Book on Tax Strategies for the Savvy Real Estate Investor” by Amanda Han and Matthew MacFarland

Tax strategies may seem advanced, but taxes are definitely something you should be concerned with as a real estate investor. Things like capital gains tax can really eat into your investment income. That’s why this book lands on the list of best books for beginner real estate investors.

This book will show you how you can deduct more, invest better and ultimately, pay fewer taxes. All the while, its tips and insights will prepare you for tax season. You can use this book to learn how you can make the most of your taxes.

12. “The Real Estate Wholesaling Bible: The Fastest, Easiest Way to Get Started in Real Estate Investing” by Than Merrill

Wholesaling is a real estate investment that involves purchasing and selling real estate contracts, which do not need a lot of initial money or prior rental property experience. It is an excellent way for individuals who don’t have cash or want to deal with tenants. It’s also more straightforward and less risky compared to flipping houses.

There are several real estate investment risks so one should have an appropriate risk mitigation plan in place. Of course, there are legal landmines to avoid depending on your local laws, so make sure you understand the process.

The Real Estate Wholesaling Bible provides the best step-by-step instructions on finding and evaluating the best wholesale deals, negotiating terms, and selling them quickly. Than Merrill, best-selling author and founder of Fortune Builders, walks readers through best practices to get started with wholesaling properties.

He covers everything you need to know about this investment approach.

13. “The Millionaire Real Estate Investor” by Gary Keller

If you need a detailed book that can help you start real estate with a millionaire mindset, this book is for you.

Before writing this book, the author interviewed 100 successful real estate investors to enable him to understand their mindset. The result led to the writing of this book, where he destroyed the various myths that create setbacks for beginners who wish to invest in real estate.

14. “Crushing It in Apartments and Commercial Real Estate” by Brian Murray

The author, Brian Murray, went from a school teacher who turned his real estate side hustle into his main hustle. This starter guide to investing is gleaned from the author’s bootstrapping days as a new investor. This book is for real estate investors of all levels of experience whether you are focused on residential investments, commercial investments, or both.

Some of the tips Murray outlined include how to:

- Creatively finance & source commercial real estate properties

- Grow a low-leverage real estate portfolio without outside investors

- Leverage your private investor status to beat out institutional competitors on deals

- Uncover hidden value to increase profits and keep expenses low

Brian Murray did an amazing job with this guide, which allows any aspiring investor to feel like they can break into the world of commercial real estate. I believe this book is one of the best real estate investing books for beginners and will be helpful for investors looking to level up into their first fourplex and even investors trading up to 20 units.

15. “Real Estate Investing Gone Bad: 21 True Stories of What NOT to Do When Investing in Real Estate and Flipping Houses” by Phil Pustejovsky

Sometimes it’s just as helpful to learn what not to do. With this book, you can avoid many of the major mistakes real estate investors and house flippers make. Learn the lessons from these investors without putting millions on the line. This is an invaluable resource for beginners because you can be aware of the risks without actually taking them.

Remember, some people paid a fortune for these lessons. You can learn them with just a purchase of the book.

What is the 5% rule in real estate investing?

The 5% rule is an easy process to assess whether it costs more to buy or rent a home. On the renting side, establishing your cost is uncomplicated: it’s the amount you pay in rent every month. On the homeownership side, though, factors are a bit more complex. The costs of owning a residential property contain more than just your mortgage payment.

This is when the 5% figure comes into action. It is a tool to compare the cost of renting to owning a home more precisely.

The three main components of the 5% rule include property tax, maintenance costs, and the cost of capital. These are costs that homeowners bear, and renters do not. Let’s break down one after another:

- Property tax. Using this uncomplicated approach, the cost of property tax would be roughly equal to 1% of the home’s value.

- Maintenance costs. Regular maintenance and repairs are significantly pricier for homeowners than for renters. This category, such as property tax, is believed to be around 1% of the house’s value.

- Cost of capital. The cost of capital makes up the remaining 3% of the 5% rule. In simplified terms, the cost of capital is what you could be earning on the money tied up in your home (usually in the form of a down payment) if it was invested in some other form, such as an investment property or the stock market. It’s a cost because of the interest you pay on your mortgage, often around 3%.

Applying the 5% rule would look like this:

- Multiply the value of the property you own/like to obtain by 5%.

- Divide by 12 (to get a monthly amount).

- If the resulting amount is costlier than you would pay to rent an equivalent property, renting your home and investing your money in rental properties may work better.

Why you should use it

Although the 5% rule is an oversimplified way to compare the costs of renting with homeownership, it can be a vital tool for rental real estate investors. You may use it not just to make personal choices regarding your personal residence; if you own rental properties in areas where the cost of living is high, you could also teach it to your tenants to help them understand the benefits of staying in your rental home longer.

In markets where property values are pretty high, this tool could prove to be a good resource as you make all future real estate investments.

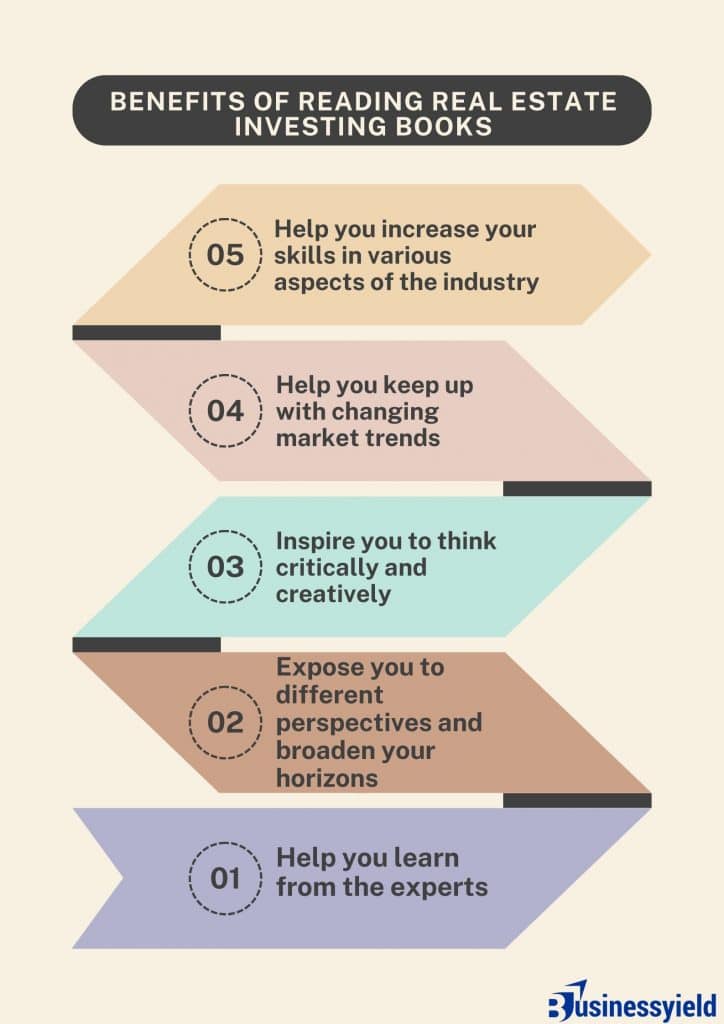

Why you should read real estate investing books as a beginner

Well, real estate investors disagree on many topics, but nearly all agree on one thing: the necessity of investing in yourself.

Reading books is one thing, but where do you start? To be successful as a new real estate investor, you need to learn but it can be hard to sift through all the books to choose from. Finding a good real estate book can be difficult, especially if you don’t read a lot.

There are literally thousands of books out there that deal with real estate investing, and I’ve probably read a lot of them! These are my choices of good books on real estate investing for this year. What about you?

Recommended Articles

- How To Become a Real Estate Developer: Ultimate Guide

- Real Estate Market Trends for Lutz, FL – Is Moving in a Good Choice Now?

- Is a Career in Real Estate Right for You?

- Homebuyer’s Guide: Navigating North Bethesda’s Real Estate Market

- Market Watch: The Intersection of Real Estate and Mortgage Trends in Texas

- First Time Renewing Your Real Estate License? Here’s What You Should Know