State Farm is one of the largest insurance companies, as it offers a wide variety of other insurance and financial products, sold exclusively by State Farm agents; this includes classic car insurance. If you are looking for a well-known brand name with a generous selection of products and consumer-friendly pricing, this carrier might be right for you.

State Farm has consistently ranked within the top three insurers for customer satisfaction over the last three years. It even has a higher NAIC complaint index than Chubb, and was awarded 856 out of 1,000 points for customer satisfaction in J.D. Power’s Small Commercial Insurance Study.

It offers business insurance designed for independent contractors, restaurants, professional services, and retailers, with paperless billing and autopay options. Commercial insurance products include BOP bundles, surety and fidelity bonds, and farm and ranch insurance.

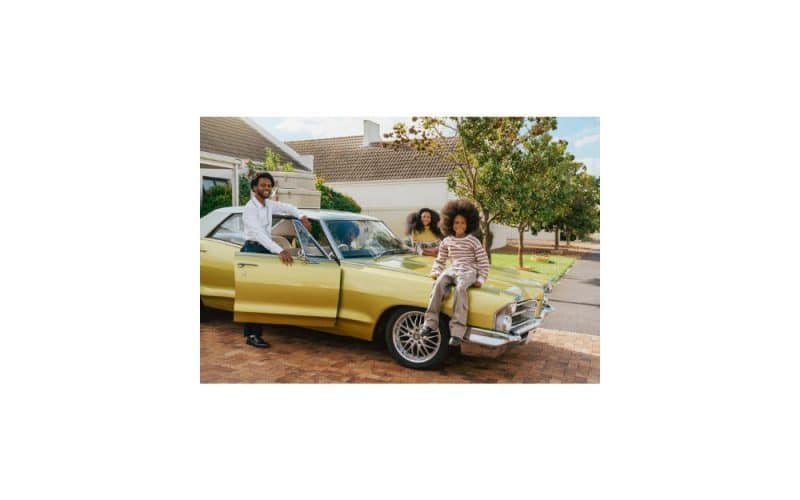

State Farm offers great options for insuring classic or collector cars from muscle cars to Model Ts. In partnership with Hagerty, the leading protector of what is known as enthusiast vehicles, the company provides classic car insurance at competitive rates.

What Is Classic car insurance coverage?

Classic car insurance coverage differs from traditional car insurance in that it’s designed for antique, vintage, classic, and collectible vehicles. These types of vehicles are often rare and even one-of-a-kind, and they require insurance policies that consider and protect their uniqueness and value.

Similar to standard car insurance policies, classic car insurance can include the six types of coverage we mentioned earlier:

- Comprehensive

- Collision

- Emergency road service

- Medical payments coverage

- Liability

- Uninsured/underinsured motorist coverage

But there are also a few key differences between classic and standard car insurance that are worth considering.

What is the difference between classic and standard car insurance?

One of the most notable differences between classic and standard car insurance is how each addresses the value of the car. Standard car insurance policies assign value to a vehicle using one of two options:

- Actual cash value: ACV is the amount your car is worth, and it takes depreciation into account. So the ACV of your vehicle is likely to be less than what you paid for it.

- Replacement cost: The replacement cost method determines the value of your vehicle based on what it would cost today to buy the same or a similar vehicle.

Classic car insurance policies, on the other hand, assign value to a specific vehicle based on the age, condition, modifications, and type of vehicle. This is known as an agreed value. When agreeing upon value, car owners and insurance companies also take into account how the vehicle will increase or decrease in value over time.

Because classic or collectible cars usually appreciate in value, it’s important to continuously assess that value and adjust the policy accordingly. Some classic car insurers may require a professional appraisal to determine and update value.

Besides the way a vehicle’s value is determined, there are a few other qualifications and limitations that differentiate a classic car insurance policy from a standard car insurance policy. We’ve outlined them below.

Limitations of classic car insurance

The biggest limitation of classic car insurance is how you’re able to use the vehicle. A classic car insurance policy may have some or all of the following restrictions:

- Low annual mileage: The more you drive, the more likely you are to get in an accident. So classic car insurance companies will often set a limit that usually ranges from 3,500 to 10,000 miles per year.

- Enclosed storage: You’ll likely be required to prove you have an enclosed space (garage or storage) to protect your classic vehicle from the elements and theft. Storage requirements vary by insurance provider. Proper storage can also mean lower car insurance premiums from some companies.

- Type of car: Age isn’t the only thing that makes a car a classic. Insurance companies require your car to have some type of historic interest or collectibility factor.

If you’re wondering if your car has historic interest and qualifies as a classic, you can check with your local Department of motor vehicles. The requirements for registering your vehicle with historic status vary by state, but your local DMV will be able to provide you with a list of specifications.

Does State Farm offer classic car insurance?

Yes, State Farm offers classic car insurance in 48 states (the company doesn’t sell new policies in Massachusetts or Rhode Island). In 2023, it partnered with Hagerty to expand coverage options to classic and antique vehicles. State Farm offers classic auto insurance for vehicles with a historic interest that are:

- 10 to 24 years old, defined as classic cars

- 25 years and older, defined as antique cars

State Farm classic and collector car insurance coverage

Because classic and collector cars are unique, they require insurance policies designed to reflect that. For example, while most modern vehicles begin to depreciate in value the minute you drive them off the lot, classic cars typically appreciate in value year after year. So to insure them properly, you need a classic car insurance policy that takes value into account.

State Farm collector and classic car insurance is designed with vintage and antique vehicles in mind. It covers vehicles with a historic interest that are at least 10 years old.

Classic car insurance policies from State Farm can include the following types of coverage:

- Liability: Liability insurance is there for when you cause damage to someone else’s property or injure someone in an accident that’s your fault.

- Collision: Collision insurance covers your car if it’s damaged in an accident, regardless of who’s at fault.

- Comprehensive: If your car is damaged by something other than a collision (like vandalism or hail) or is stolen, comprehensive coverage protects you.

- Medical payments coverage: MedPay covers medical bills for you and your passengers if injured in an accident, regardless of who was at fault.

- Underinsured/uninsured motorist: Underinsured/uninsured motorist coverage is for when someone hits you and doesn’t have insurance or enough insurance.

- Emergency road service: State Farm roadside assistance covers towing and labor costs if your car breaks down.

Working with a State Farm agent, you can determine which coverages you need based on your vehicle’s value and use. For example, if you go to car shows or use it for pleasure driving. However, note that some coverage options may not be available in your state.

State Farm classic car insurance requirements

To qualify for State Farm classic car insurance, your vehicle needs to have historic interest and be either antique or classic. This means:

- Antique vehicles that are at least 25 years old

- Classic vehicles that are 10 to 24 years old

In addition to having eligibility rules for age and historic interest, State Farm specifies that the vehicles should be:

- Driven on a limited basis

- Restored and maintained or actively undergoing restoration

- Kept in an enclosed building

If your antique or vintage car meets these qualifications, a State Farm insurance agent can help you find coverage that meets your needs.

What is an antique or classic car?

Aside from State Farm’s requirements for classic car insurance, there are other guidelines for what qualifies as an antique or classic vehicle. According to American Collectors Insurance, these are the standards:

- Vintage cars were manufactured between 1919 and 1930.

- Antique cars were manufactured before 1976.

- Classic cars were manufactured before 2001.

Car buffs and enthusiasts often disagree about the differences between the three, and they may use the terms classic, vintage and antique interchangeably to describe all types of old and collectible vehicles. For example, LaFontaine Automotive Classic Cars defines vintage cars as 25 or older, classic cars as 20 to 45 years old and antique cars as 45 or older.

Because these specifications overlap, for the purposes of insurance, we’ve simplified the descriptions of vintage, antique and classic vehicles below.

Vintage vehicles

Although you may expect antique cars to be the oldest of the bunch, by classic car insurance standards, vintage vehicles are older.

When it comes to insurance companies, vintage cars run the gamut in age range. Some companies define vintage cars as 45 and older, while others specify 50 or older. State Farm insurance includes vintage cars in the antique category at 25 years or older.

Antique vehicles

Most classic car insurers, including State Farm, define antique cars as being 25 or older. Some insurance companies put a cap on how much older they are.

Classic vehicles

Most insurance companies define classic cars as 10 to 25 years old. But again, this can vary from insurer to insurer.

How do I know if my car is classic, antique or vintage?

If the gearheads and car buffs can’t agree, it can be difficult to know for sure if your car is considered classic, antique or vintage. While there’s no simple answer, as a general rule of thumb, if your car is at least 25 years old and holds historic or collectible interest, then it most likely qualifies for classic car insurance.

When shopping for classic car insurance, familiarize yourself with the parameters insurers use for classifying vehicles. Although different insurance companies may use different terminology for your car, most will offer similar coverage options whether your vehicle is classic, vintage or antique.

State Farm car insurance discounts

When shopping for car insurance, it’s important to ask about car insurance discounts. There may be ways to lower car insurance premiums with a discount or two or even more. (Not all discounts are available in every state.)

Here are some discounts you are likely to see from State Farm:

- Accident-free discount. If you drive without having an accident for three years in a row, you can qualify for an accident-free discount from State Farm.

- Good student discount. If a student is aged 16 to 25, is going full-time to high school or college, and has a B average, 3.0 grade point average or other qualifications, you can save up to 25% discount on car insurance from State Farm.

- Loyal customer discounts. Insure more than one car with State Farm and you could save as much as 20%. Insure a home or a condo or sign up for life insurance or renters insurance with State Farm alongside your auto insurance policy and you can save up to 17% with a multi-policy discount.

- Defensive driving course discount. Take a defensive driving class and you may be eligible for a discount of 10% to 15%.

- Good driving discount. Keep a good driving record for three years with no at-fault accidents or moving violations and you’ll qualify for a discount.

- Driver training discount. If young drivers under age 21 complete driver training, you’ll get a discount.

- Student away at school discount. If one of the drivers of your vehicle is a student under age 25 who moves away to go to school, you may be eligible for a discount.

- Anti-theft discount. If your car has an alarm or other anti-theft device, you may qualify for a discount.

- Multi-vehicle discount. You’ll get this price break if you insure more than one vehicle with State Farm.

Other State Farm tools and benefits

State Farm offers several benefits that may make the carrier worth looking into. These include:

- Local agents: The company offers an exclusive network of more than 19,000 local agents across the U.S. This may make the company accessible and easy to work with.

- Digital tools: State Farm offers a user-friendly mobile app and several online tools that allow policyholders to digitally view documents, make payments, claims-filing and access customer support.

- Landlord insurance: If you own a property that you rent out to tenants, you might be interested in State Farm’s rental insurance. This landlord insurance offering includes standard coverage as well as coverage for loss of rent due to a covered peril.

- Umbrella insurance: Umbrella insurance may help protect your finances by paying additional liability coverage for home and auto policies in the event of a major liability claim or lawsuit.

- Identity theft protection: For around $25 per year, you may add identity theft protection to your home, condo or renters insurance policy. Policies are available in all states except for North Carolina.

- Boat insurance: State Farm’s standard boat insurance policy includes liability coverage in addition to protection from sinking, storms, theft and other perils.

- Motorcycle insurance: State Farm’s motorcycle insurance policies may include coverage for attached sidecars and motorcycle protective gear.

- ATV and off-road vehicle insurance: State Farm takes a liberal approach to which off-road vehicles it includes in its policies; camping trailers, snowmobiles, golf carts and even dune buggies may all be insured with State Farm.

- Renters insurance: State Farm is on Bankrate’s list of the best renters insurance companies.

- Personal banking: State Farm offers a suite of personal banking products through its partnership with US Bank®, like credit cards and checking accounts.

Recommended Articles

- TOP BEST RV INSURANCE OF 2023: Review

- HOW TO SHOP FOR CAR INSURANCE: Easy Methods & Steps

- Best Car Warranty Companies For 2023: Reviewed

- CHEAPEST CAR INSURANCE IN MASSACHUSETTS FOR 2023

- Best Cheap Car Insurance for Teens: Top 5 in 2023

- National General Insurance: Review 2023