The Ohio small business health insurance market comprises primarily four major national carriers and one local carrier. Compared to some of the other states, carriers in Ohio offer fewer tiers of networks, with most carriers electing to only offer a full network to small businesses.

This makes selecting a health insurance plan much easier for small businesses, with the primary decision coming down to which health insurance carrier to choose. Ohio’s market is pretty competitive, with most of the carriers offering competitive rates.

If you’re a small business owner in Ohio, you may qualify for a tax credit that could cover some of the costs you pay for employees’ premiums.

Overview of small business health insurance in Ohio

If you are a small business owner with 25 full-time employees or less, and pay an average salary less than or equal to $50,000 a year, you might be eligible for a tax credit. This tax credit was created under the Patient Protection and Affordable Care Act (PPACA) in order to give small businesses and tax-exempt organizations a break on the cost of group health insurance for their employees.

The federal tax credit will reimburse qualifying small businesses for up to 50% of the premiums they pay toward employee medical, vision, and dental insurance. Tax-exempt organizations may qualify for a tax credit of up to 35% of premium expenses.

Small businesses with fewer than 10 full-time employees that pay average annual wages of $25,000 or less may qualify for the full credit. The amount of the credit is reduced for companies with more full-time workers and higher wages, until it is phased out entirely for those with 25 or more full-time workers and average annual wages over $50,000.

Because eligibility rules are based in part on the number of full-time employees, not the total number of all employees, businesses that use part-time help may qualify even if they employ more than 25 individuals.

There are two primary categories of health insurance for small businesses in Ohio to choose from:

- Individual health insurance,

- Group health insurance.

Individual health insurance

Individual health insurance plans are health insurance plans purchased by individuals to cover themselves or their families. Anyone can apply for individual health insurance. Small business owners who can’t offer group coverage due minimum contribution (or minimum participation) requirements typically purchase individual and family plans for themselves and their families.

In some cases, self-employed persons who purchase their own health insurance may be able to deduct the cost of their monthly premiums. When small businesses decide on the individual health insurance route, they often create a “Pure” Defined Contribution Health Plan to reimburse employees tax-free for individual premiums.

Group health insurance

Group health insurance plans are a form of employer-sponsored health coverage. Costs are typically shared between the employer and the employee, and coverage may also be extended to dependents. In certain states, self-employed persons without other employees may qualify for group health insurance plans.

Types of small business health insurance plans in Ohio

As a small business owner, you can choose from five types of healthcare plans for your business.

HMO (Health Maintenance Organization)

An HMO is designed to keep costs low and predictable by only using doctors and hospitals within the HMO network. It typically has low premiums, deductibles, and fixed copays for doctor visits. Primary care physicians (PCP) are the primary point of contact for all medical care, including specialty referrals.

PPO (Preferred Provider Organization)

PPO networks let you choose where to go for care, without a referral from a PCP or having to only use providers in your plan’s provider network. These plans typically have higher monthly premiums and out-of-pocket costs like copays, coinsurance, and deductibles.

HSA-Qualified

HSA-qualified plans are typically PPO plans designed specifically for use with Health Savings Accounts (HSAs). An HSA is a special bank account that allows participants to save money – pre-tax – to be used specifically for medical expenses in the future. Section 105 Healthcare Reimbursement Plans (HRPs) are often used in place of HSAs due to their advantages for employers.

Indemnity

Indemnity plans allow members to direct their own health care and generally visit any doctor or hospital. The insurance company then pays a set portion of the total charges. Employees may be required to pay for some services up front and then apply to the insurance company for reimbursement.

Ohio health insurance monthly cost

- Group Plans: Costs depend on employer contribution and the + 20% of the Insurance company’s Index rate.

- Individual Plans: Costs for Individual coverage vary. There are no rate caps.

- COBRA: Costs vary between 102% to 150% of group health rates.

- HIPAA: Premiums will depend on plan chosen.

- HIPAA: Reimburses the full employer-sponsored insurance premium amount by check monthly. Pays the insurance company directly for people on COBRA or eligible small businesses.

In general, business owners in Ohio can expect to pay at least $201 per employee for small business health insurance coverage. This price varies based on a number of factors, including employee age and gender.

Best small business health insurance providers in Ohio

Anthem Blue Cross

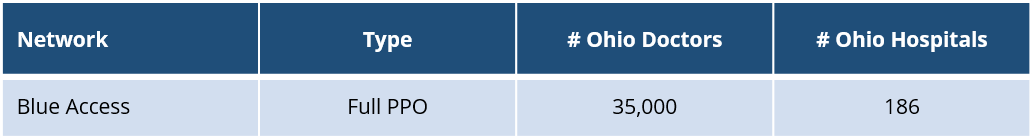

Anthem Blue Cross is a part of Wellpoint and offers medical, dental, and vision coverage. Its plans offer access to a very strong statewide network, and national coverage through the BCBS BlueCard network. The company only offers a single PPO network in Ohio.

Anthem plans are currently among the most competitive for small businesses, and are a very good value for companies looking for cost savings and access to broad networks.

Network Overview

- Blue Access: Blue Access is Anthem’s PPO network for small businesses, and is a very broad Ohio network. Plans on Blue Access includes access to the national BlueCard network.

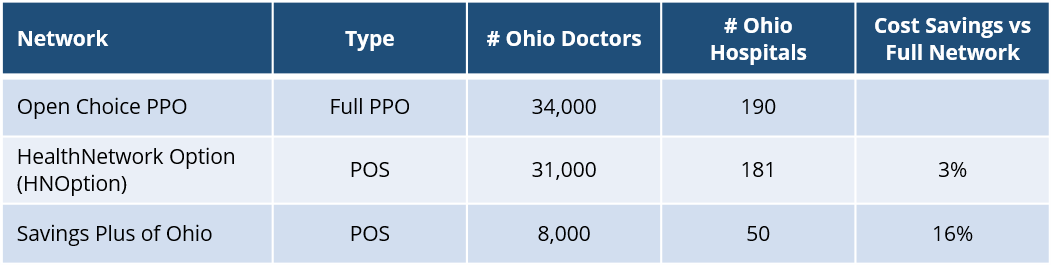

Aetna

Aetna is a national carrier offering medical, dental, and vision coverage. Its several networks including PPO and HMO networks options, and allows companies can mix and match up to 5 different plans to offer employees. Aetna’s full PPO and HMO networks are very broad and includes a large number of hospitals and doctors.

Aetna plans are currently among the most competitive for small businesses, and are a very good value for companies looking for cost savings and access to broad networks.

Network Overview

- Open Choice PPO: Aetna’s largest network in Ohio, with access to expansive network of doctors and hospitals. Offers nationwide coverage through Aetna’s national network.

- HealthNetwork Option (HNOption): HNOption is a point-of-service plan that encourages but does not require the use of a primary care physician. While a very broad network, it is smaller compared to the full PPO and only represents a small cost savings.

- Savings Plus of Ohio: Savings Plus is a narrow network comprised of medical providers with lower negotiated costs to Aetna, and only available to companies in the greater Cleveland and Cincinnati region. Plans are ~16% less expensive than the full network.

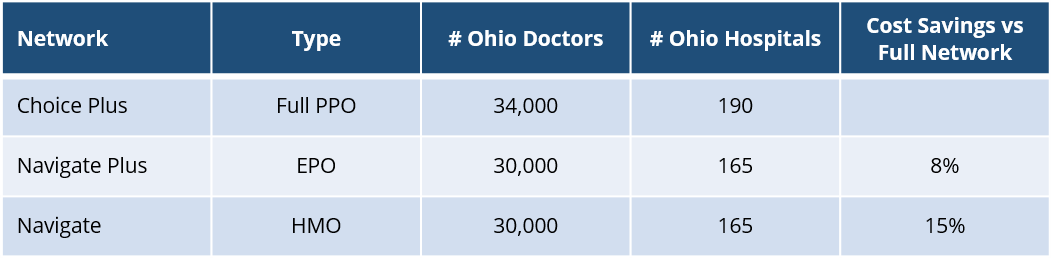

United Healthcare

United Healthcare is the largest carrier in the country, and offers medical, dental, and vision coverage in Ohio. Its PPO plans provide access to the nationwide United Healthcare network. United Healthcare offers several tiers of coverage including PPO. EPO, and HMO networks, thought focuses primarily on the PPO network.

United plans are competitive, but more expensive than the comparable plans offered by the other national carriers.

Network Overview

- Choice Plus PPO: Full PPO network with access to one of the largest network of doctors and hospitals in Ohio and nationwide coverage through United Healthcare’s national network.

- Navigate Plus EPO: The Navigate Plus EPO network utilizes the same network as the Navgiate HMO, with the primary advantage of not requiring a primary care physician referral for specialisit visits. Navigate Plus EPO plans are 8% less expensive than the full PPO, though only silver and gold plans are available.

- Navigate HMO: Large HMO network with 5088of the doctors and 87% of the hospitals of the PPO network. One of the only HMO networks available to small businesses in Ohio, and plans are ~15% less expensive than the full PPO.

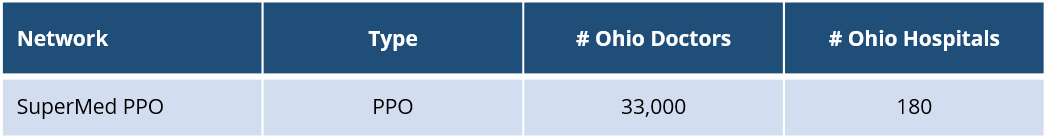

Medical Mutual

Medical Mutual is a regional carrier that offers medical coverage primarily in Ohio. Its small business plans utilize the SuperMed PPO network. The SuperMed PPO network is an expansive Ohio network, and includes access to a large population of doctors and hospitals.

Medical Mutual plans are pretty competitive in Ohio, though are more expensive than comparable plans offered by national carriers.

Network Overview

- SuperMed PPO: Small business PPO network with access to large number of doctors and hospitals. Plans on SuperMed PPO have access to a national doctor network through a partner network (MultiPlan).

Humana is a national carrier and offers medical, dental, and vision coverage in Ohio. Humana only offers a single PPO network in Ohio. While expansive, Humana’s PPO network is smaller compared to the PPO networks on other carriers.

Humana

Humana is very small business friendly, and covers many classes of small businesses that other insurance carriers do not, such owner-only companies and husband/wife-only companies. However, Humana plans are among the most expensive options for small businesses in Ohio.

Network Overview

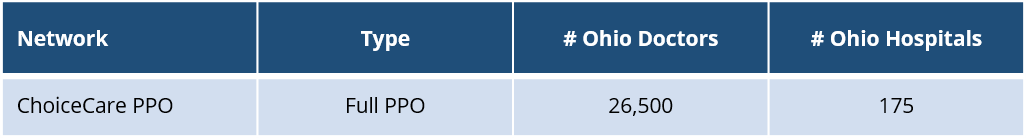

- ChoiceCare PPO: Full PPO network with access to a large doctor network and nationwide coverage on Humana’s national network.

What classifies as a small business?

The U.S. Small Business Administration (SBA) defines a small business as an independent business that has fewer than 500 employees. However, this definition can vary by industry.

For insurance purposes, only small- to medium-sized businesses that meet certain requirements are eligible for a BOP, according to the III. Insurers in Ohio may consider several factors when assessing whether a business is eligible for a BOP, which include:

Number of employees

One of the primary factors used to classify a business as small is how many people it employs. Typically, businesses with fewer than a certain number of employees are considered small. The threshold is determined by the insurance provider and can range from a handful of employees to several hundred, depending on the industry and the specific insurance policy.

Ownership structure

The ownership structure of a business can also impact its classification as small, according to the SBA. In some cases, insurance providers may consider factors such as whether the business is independently owned and operated or part of a larger corporate entity.

Industry classification

Certain industries have their own unique standards for defining small businesses. For example, the SBA sets industry-specific size standards based on the number of employees or annual revenue. These standards help determine eligibility for government programs and contracts.

Annual revenue

In addition to the number of employees, the SBA considers the annual revenue of a business when determining its size. Similarly, insurance providers may set a maximum revenue threshold for small businesses.

It’s worth noting that the definition of a small business may differ among insurance providers, so it is essential to carefully review your policies and consult with your insurance providers to ensure you meet the specific requirements for coverage.

How does small business health insurance work?

There are four main elements that you, as a small business owner, should be aware of concerning small business health insurance. These are:

Coverage

First and foremost, if you are eligible for a small business health insurance plan, your coverage is generally guaranteed to be issued by the insurance company. This means that you, your employees and your dependents cannot be denied coverage based on pre-existing medical conditions.

Also, all eligible employees and their dependents can enroll in the new plan regardless of their medical condition(s).

Number of employees

To qualify for small business health insurance coverage, you must have at least one employee on your payroll. However, some states allow you to count yourself as both a business owner and an employee.

You must pay at least 50% of the monthly health insurance premiums for your employees. The minimum percentage may vary depending on your state or insurance company.

Shopping for coverage

As a small business owner, you can shop around for health insurance coverage at any time, without needing to wait for your current plan to expire or for a special open enrollment period. However, once you buy a plan, you are typically locked in for at least a year, during which you can add new employees and dependents or drop coverage for former employees.

Once your contract is up, you have the option to renew or shop for a new plan.

Recommended Articles

- Best Commercial Auto Insurance Providers 2023

- WORKERS COMPENSATION VIRGINIA: The Ultimate Guide

- BEST INSURANCE COMPANIES IN NORTH CAROLINA 2023

- Business Liability Insurance: Meaning, Types & Coverage

- Business Insurance Quotes: Getting Insurance Quote Online

- Navigating the Insurance Maze: Tips for Finding Your Perfect Coverage