Many Nigerians use lending apps to get rapid financing, however, these apps sometimes come with hidden drawbacks, such as unlawful access to personal information like phone contacts. I discovered this the hard way after downloading a lending app, which began sending unwanted messages to my contacts, embarrassing me and harming my reputation. If you find yourself in a similar circumstance, you are not alone. In this post, I’ll show you how to stop loan apps from accessing your contacts, and protecting your privacy.

Why Do Loan Apps Access Your Contacts?

Most loan applications in Nigeria require access to your phone contacts throughout the registration procedure. They claim it helps to verify your identification and analyze your creditworthiness, but in reality, many of them utilize this access to harass your friends and family if you default on a loan.

According to Statista research from 2023, the number of Nigerians using online lending platforms has increased due to their ease of use, but so have privacy worries. Loan applications are renowned for sending threatening messages to borrowers’ connections, even when they have not defaulted. This technique has caused privacy and legal problems, and many users desire to regain control over their data.

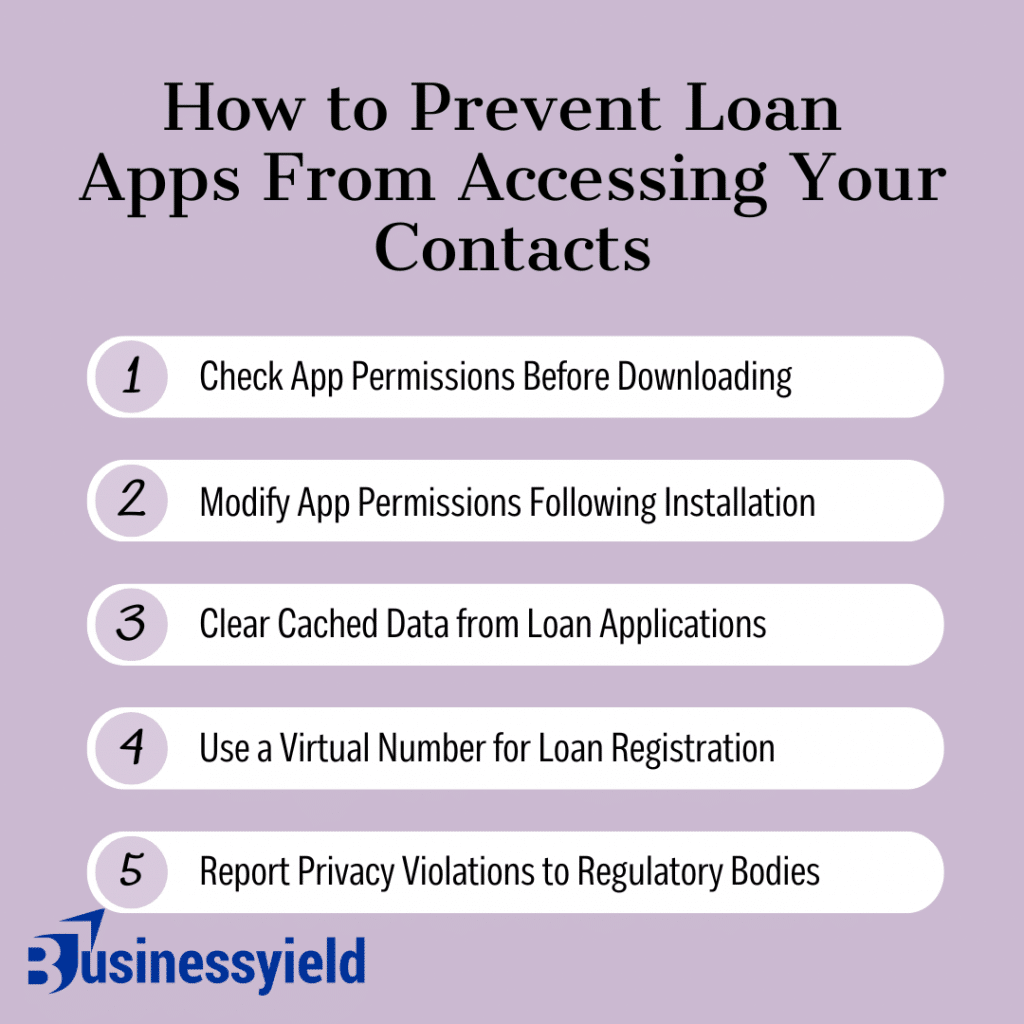

How to Stop Loan Apps From Accessing Your Contacts

#1. Check App Permissions Before Downloading

One of the most effective ways to keep loan apps from accessing your contacts is to prohibit them from doing so in the first place. Before downloading any lending app, carefully consider the permissions it requires.

- Steps to take:

- Install the lending app, which will request permission to access your phone’s contacts.

- Choose deny access to your contacts. This prevents the app from reading or uploading your phonebook.

I’ve made it a point to check each app’s permissions before installation. I avoid using apps that need more data than appears essential (such as contacts or location). Not all lending apps demand such intrusive permissions; thus, it’s worth looking into alternatives.

#2. Modify App Permissions Following Installation

If you’ve already installed a loan app that has access to your contacts, you can disable it by changing your phone’s settings. Android and iPhone users can cancel app permissions, including contact access.

- On Android, navigate to Settings > Apps & Notifications > App Permissions.

- Locate the loan app and turn off Contacts to stop it from accessing your contacts.

On iPhone, go to Settings and find the lending app.

- Turn off the Contacts permission.

After unintentionally granting access to a lending app, I promptly went into my phone’s settings and removed permission. It was reassuring to know that I could still manage what the program accessed, even after installation.

#3. Clear Cached Data from Loan Applications

Loan apps frequently save contact information in cached storage, even after you revoke their rights. To verify that the app no longer has access to your contact list, delete its cached data from your phone.

On Android, go to Settings > Storage > Apps, select the loan app, then press Clear cache.

- On iPhone, uninstall and reinstall the program without providing access to your contacts. Tip: Clearing cached data regularly helps to ensure that the software does not retain access to your personal information.

#4. Use a Virtual Number for Loan Registration

Another way to preserve your anonymity is to use a virtual number while registering for loan applications. This stops the app from connecting your phone number with your contact list, which further protects your information.

To obtain a virtual number, use programs such as Google Voice or Hushed that offer a secondary number.

- Register the loan app using this virtual number rather than your real one.

#5. Report Privacy Violations to Regulatory Bodies

If a lending app continues to misuse your contacts after you’ve taken steps to prevent it, you should notify the proper authorities. In Nigeria, loan app exploitation has been investigated, and measures are being taken to protect consumers.

- Who to report to:

- Contact the National Information Technology Development Agency (NITDA), which oversees data privacy in Nigeria.

- File a complaint with the Federal Competition and Consumer Protection Commission (FCCPC), which has taken action against lending apps that engage in unethical tactics.

- Tip: When reporting privacy issues, attach screenshots or other evidence that the lending app is accessing your contacts without your consent. This will allow regulators to investigate and respond faster.

Can I prevent loan apps from seeing my contacts after downloading?

Yes, you can prevent loan apps from accessing your contacts even after you download the app. It is as simple as changing your phone’s settings.

For Android users:

- Go to Settings: Access your phone’s settings.

- Go to Apps & Notifications: Locate the loan app among your installed apps.

- Click the Permissions: Turn off Contacts to prevent the app from accessing your phonebook.

To iPhone Users:

- Go to Settings: Locate the loan app among your installed apps.

- Toggle Off Contact Access: If you disable access to contacts, the app will no longer be able to access your phonebook.

This gives you control over what data the app can access, even after installation.

What Should I Do If a Loan Application Contacts My Friends or Family?

If a lending app has already contacted your friends or family, take the following actions:

- Revoke Contact Access: Go to your phone’s settings and deny the app access to your contacts.

- File a Complaint with the App: Contact the loan app’s customer service and ask them to stop contacting your friends and family. Maintain a record of this correspondence.

- Report the Issue: If the harassment continues, contact NITDA or FCCPC and provide evidence such as screenshots or messages as proof.

Quick action can help you avoid additional embarrassment and protect your privacy.

Can I still use loan apps without giving them access to my contacts?

Yes, some loan apps can function without access to your contacts. However, not all apps support this, therefore, it is advisable to look into privacy-friendly apps like Carbon or Branch, which may provide more transparency. Always test loan apps by blocking contact access during setup to ensure they still work.

Why Do Loan Applications Need Access to My Contacts?

Loan apps claim to require access to contacts for two primary reasons:

- Identity Verification: They claim it helps authenticate your identity and prevents fraud.

- Creditworthiness Assessment: Some apps use your contact list to assess your social and financial stability.

However, many apps abuse this access, sending nasty messages to your contacts in the event of a default. It is safer to avoid loan applications that require excessive access.

How Can I Protect My Information When Using Loan Apps?

- Deny Unnecessary Rights: Grant only needed rights, such as file storage, and always deny contact access.

- Use a Virtual Number: When signing up for loan apps, use a virtual number to avoid linking your contacts.

- Remove Cached Data Regularly: To ensure that programs do not retain old data, remove their cache files.

- Read Privacy Policies: Always read the app’s privacy policy to learn how it handles your data.

- Report Privacy Violations: If your data has been misused, notify NITDA or FCCPC so that action can be taken.

Key Takeaways

- Before downloading a lending app, always review the permissions it requires to avoid granting unwanted access to your contacts.

- If you’ve already provided access, go to your phone’s settings and withdraw the rights so the app can’t access your contacts.

- Clear cached data regularly to prevent lending apps from storing inappropriate contact information.

- To increase anonymity, register lending apps with a virtual number rather than adding your contacts to the app.

- If a lending app misuses your contacts, notify NITDA or FCCPC for regulatory action.

Conclusion

Loan apps in Nigeria frequently overstep their boundaries by accessing personal contacts, but with the correct measures, you may secure your privacy. You may stop loan apps from accessing your contacts in a variety of ways, including reviewing permissions, removing cached data, and using a virtual number. If you believe a lending app has abused your privacy, report it to the appropriate authorities.

How have you maintained your privacy when utilizing lending apps?

- Full List of Fake Loan Apps in Kenya: How to Spot and Avoid Them

- Okash Loan: Everything You Need to Know About It

- Quick Loans for Your Business

- 10 Best Loan Apps in Nigeria: What You Need to Know Before Borrowing

- WHEN DO STUDENT LOANS START AGAIN? Detailed Guide