Loans are now more accessible than ever before, thanks to the growth of smartphone lending apps. However, this simplicity has led to the proliferation of fraudulent lending apps that exploit customers, inflicting more harm than good. A few months ago, I found myself locked in a frustrating loop with one of these apps, and I can assure you that it is not a place anyone wants to be. If you, like me, are looking for dependable financial solutions, this post will walk you through the complete list of fake loan apps in Kenya, as well as how to protect yourself.

Why Fake Loan Apps Are on the Rise in Kenya

According to a Statista analysis, Kenya’s digital lending business has developed dramatically over the years, with over 6 million digital loans given as of 2023. While this promotes financial inclusion, it has also resulted in the proliferation of unlicensed and fraudulent loan apps that prey on naïve consumers. Many of these applications promise speedy loans at low interest rates, but instead extort customers with excessive fees, privacy violations, and even public shaming.

The Digital Lenders Association of Kenya (DLAK) has been working hard to combat the proliferation of these bogus apps, but consumers should be aware of the hazards.

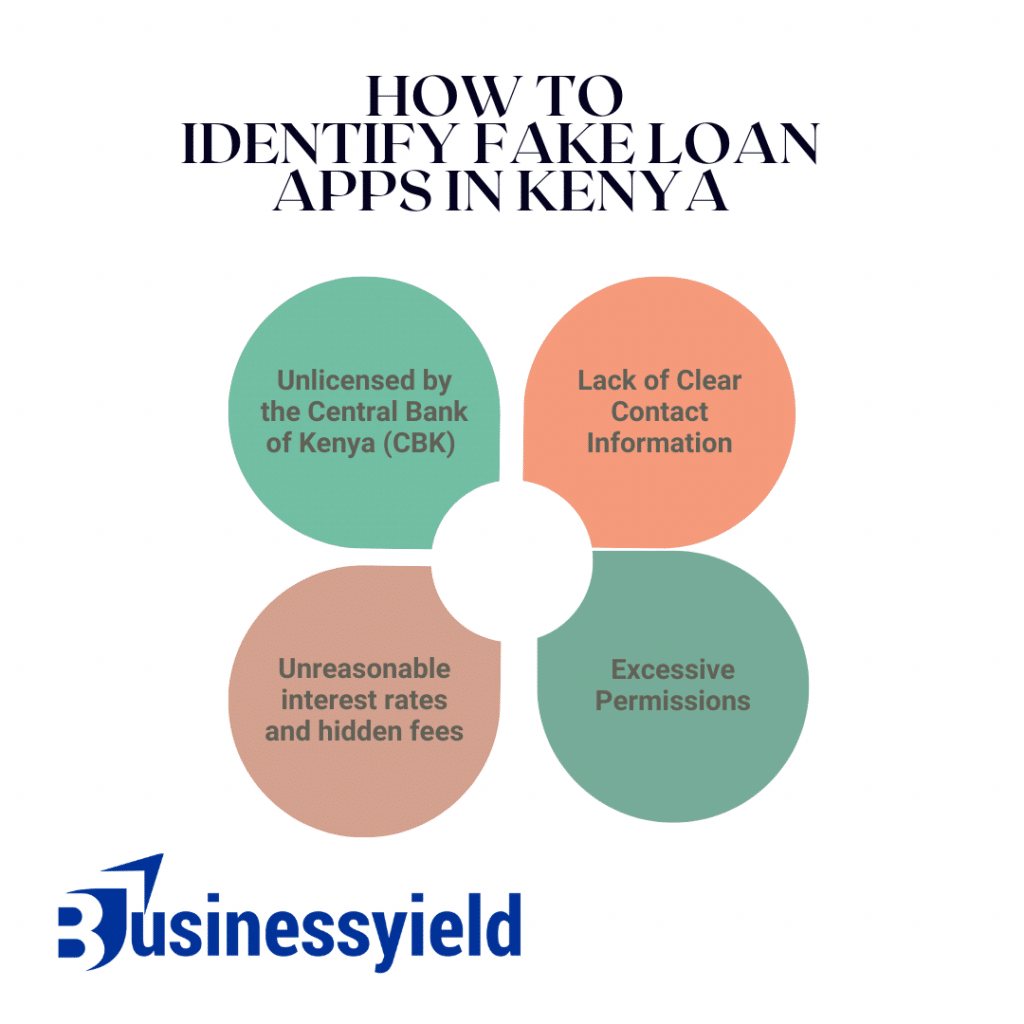

How to Identify Fake Loan Apps In Kenya

Before we go into the list, it’s important to understand how to identify fake loan apps. Here are some red indicators to help you identify them.

#1. Unlicensed by the Central Bank of Kenya (CBK)

The CBK registers and grants licenses to legitimate loan apps. If a loan application isn’t displayed on the CBK website, it’s a big red flag. Fake loan applications frequently operate without legal backing, which allows them to engage in predatory lending activities without being held accountable.

#2. Lack of Clear Contact Information

Fake loan apps typically do not provide accurate contact information, customer support, or actual addresses. Avoid apps that merely supply a generic email address or no contact information at all.

Most bogus loan applications entice customers with promises of cheap interest rates but then slap them with exorbitant fees and hidden costs once the loan is granted. If the app does not explicitly define the lending terms, it is most certainly a scam.

#4. Excessive Permissions

Watch out for lending apps that ask for unnecessary rights, like as access to your contacts, location, or images. Fake loan apps frequently exploit these capabilities to harass borrowers and contact friends and family members.

My friend mistakenly utilized a phony loan app, which began harassing his connections when he missed a payment. It was a difficult event that may have been avoided had he been aware of the warning indications.

Complete List of Fake Loan Apps in Kenya

Here is a list of fake loan apps in Kenya that users and authorities have reported. This list includes loan apps with a history of exploitative behavior that do not have Central Bank of Kenya (CBK) licenses:

#1. Shika Loan

- Why it’s fake: Shika Loan has been accused of harassing borrowers by accessing their contacts and sending threatening texts. It is not registered with the CBK, making it a dangerous choice.

- User Experience: Many consumers have complained about being charged hidden fees and receiving repeated threats despite repaying their loans.

#2. Okash

- Why It’s Fake: Okash was originally a popular loan app; however, it was removed from the Google Play Store owing to privacy issues. The app proceeded to harass individuals by calling their family and friends and requesting payback.

- User Experience: Borrowers stated that Okash charges high fees and has arbitrary payback dates.

#3. CashBee

- Why it’s fake: CashBee is notorious for its exorbitant interest rates and unregulated operations. It has been accused of compromising users’ privacy by accessing their contacts without permission.

- User Experience: Many users have complained about CashBee’s unscrupulous business tactics and reluctance to follow payback arrangements.

#4. GoCash

- Why it’s Fake: GoCash is not registered with the CBK and has been accused of deceptive lending practices. It frequently charges customers for loans that were never disbursed.

- User Experience: Borrowers have reported paying fees for loans they did not obtain and being pressured about non-existent debts.

#5. Fast Money

- Why it’s Fake: Fast Money operates without a license and has been linked to frauds involving hacked bank account information.

- User Experience: Several consumers have reported illegal transactions since signing up with Fast Money.

#6. Instant Cash

- Why it’s fake: Instant Cash has a history of misrepresenting terms and conditions, frequently hidden in fine text. The app is unregulated, and users have reported being harassed for debts that do not exist.

- User Experience: Many borrowers were duped into accepting loans with hidden costs and onerous payback terms.

#7. LendPlus

- Why it’s fake: LendPlus is unauthorized software that targets low-income consumers. It frequently grants loans without clear stipulations, only to charge exorbitant fees afterward.

- User Experience: Borrowers have complained that LendPlus makes it nearly impossible to reach customer service, particularly when problems develop.

How to Protect Yourself from Fake Loan Apps In Kenya

If you’re concerned about falling prey to phony loan apps, here are some practical things you can take to protect yourself.

#1. Verify the app’s licensing with CBK

Always check if a loan application is registered with the Central Bank of Kenya (CBK). The CBK’s official website provides a list of approved digital lenders.

#2. Read User Reviews

Before downloading any lending app, examine the customer reviews on Google Play or Apple App Store. Real people frequently share their experiences, and their input can be really useful.

#3. Avoid Apps with Excessive Permissions

Be aware of apps requesting access to your contacts, images, or location. Only give rights that are directly relevant to the loan application procedure, such as access to your phone number or identification verification.

How Can I Tell If a Loan Application Is Fake?

To identify bogus loan apps, search for these crucial signs:

- Unlicensed Operations: Always verify that the software is licensed by the Central Bank of Kenya (CBK). Apps not found on the CBK website should be avoided.

- Excessive Permissions: Fake loan apps frequently request inappropriate access to your contacts, location, and other sensitive information. Legitimate apps should only seek permissions required for loan processing.

- Unclear Terms and Hidden costs: If the loan terms, costs, or payback schedules are unclear, it’s a bad sign. Reliable apps are open about their prices and limitations.

- Poor User Reviews: Read reviews on platforms such as Google Play. Complaints about harassment and hidden charges indicate that the app may be a fraud.

- Lack of Contact Information: Legit apps include explicit contact information and customer support. If an app does not provide a mechanism to contact customer service, it may be fraudulent.

What Should I Do If I’ve Used a Fake Loan Application?

If you used a bogus loan app, follow the procedures below:

- Revoke Permissions: Go to your phone’s settings and deny the app access to your contacts, location, and other critical information.

- Change Passwords: Protect your personal information by immediately updating your phone, email, and banking passwords.

- Report the App: If you believe the app breached your privacy or participated in unethical acts, file a complaint with the CBK, DLAK, or Office of the Data Protection Commissioner (ODPC).

- Monitor Your Bank Accounts: Keep an eye on your account for any unusual activity, and report any unauthorized transactions to your bank.

How Do I Report Fake Loan Applications?

If you’ve met a fraudulent lending app in Kenya, you should report it to protect yourself and others from falling prey to their unethical tactics. Here is a step-by-step procedure for reporting these apps:

#1. Report to the Central Bank of Kenya

The Central Bank of Kenya (CBK) regulates digital lenders and supervises regulated financial firms. If you use a lending app that is not registered with the CBK or engages in fraudulent behavior, you can report it to them directly.

- To report, visit the CBK’s official website.

- Go to the Contact Us area.

- Send an email with your complaint to complaints@centralbank.go.ke.

- Alternatively, you can send a letter to the Consumer Protection Department at CBK’s Nairobi headquarters, detailing your experience with the loan app.

- Tip: Include the name of the app, the nature of your complaint (e.g., illegal access to contacts, harassment), and any screenshots or proof to back up your report.

#2. Submit a Complaint to the Digital Lenders Association of Kenya

The Digital Lenders Association of Kenya (DLAK) represents authorized digital lenders in Kenya. They also accept complaints regarding unethical lending practices and can take legal action against bad lenders.

- To report, visit the DLAK official website.

- Go to the Consumer Protection area and fill out a complaint form.

- Provide specific information about your experience with the phony loan app, such as screenshots, email exchanges, and the lender’s identity.

- Tip: Make sure to note any unlawful or unethical acts by the app, such as harassment, overcharging, or excessive data use.

#3. Report to the Office of the Data Protection Commissioner

If the loan app has mishandled your information, such as accessing your contacts or sending unsolicited messages, you can register a complaint with the Office of the Data Protection Commissioner (ODPC). This office oversees compliance with the Data Protection Act 2019, which safeguards your data rights.

- To report, visit the ODPC website.

- Submit a data breach complaint via the web portal.

- Give specifics regarding how the app breached your privacy, such as unlawful access to your contacts or misuse of your phone data.

- Tip: Include any evidence of the violation, such as messages sent to your contacts or logs of unauthorized access to your data.

#4. Report to Google Play or Apple App Store

You can also report false or fraudulent loan apps directly to the platform from which you obtained them, such as the Google Play Store or the Apple App Store. These platforms have policies prohibiting apps that abuse user privacy or participate in fraudulent behavior.

To report on Google Play, follow these steps: –

Open the Google Play Store and navigate to the loan app page.

- Scroll to the Flag as Inappropriate area.

- Choose Other Objection and describe the problem (e.g., data privacy breach, harassment).

To report on the Apple App Store, follow these steps:

- Visit the lending app’s page.

- Scroll down and choose Report a Problem.

- Follow the steps to file a complaint.

- Tip: Reporting the app to Google or Apple may result in its removal from the store, especially if other customers have identical concerns.

#5. Contact the Federal Competition and Consumer Protection Commission (FCCPC)

If the lending app has engaged in unfair practices such as charging hidden fees or harassing customers, you can file a complaint with the Federal Competition and Consumer Protection Commission (FCCPC), which oversees consumer protection in Kenya.

- To report, go to the FCCPC website and fill out a consumer complaint form.

- Provide all relevant information, including the name of the lending app and the nature of the complaint, such as unfair costs, harassment, or unlawful access to personal data.

Can I Remove Fake Loan Apps from My Phone?

Yes, you can eliminate phony loan applications by following these steps:

- Uninstall the App: Navigate to your phone’s app management and remove the bogus loan app.

- Clear Cached Data: After uninstalling, remove the app’s cached data from your phone to prevent future access.

- Reset Permissions: Make sure that no other apps on your phone are still exchanging data with the loan app that you removed.

- Monitor Data Usage: After uninstalling the app, look for strange data usage to ensure no malware is left on your phone.

Are all loan apps on Google Play legit?

No, not all loan applications on Google Play are authentic. Some phony apps get through the cracks. Here’s how you can defend yourself.

- Check CBK Licensing: Check the app’s licensing against the CBK’s approved lenders list.

- Read Reviews: Look through customer reviews on Google Play for any recurring complaints regarding privacy violations or hidden fees.

- Verify Developer Information: Legitimate programs provide clear developer information and a firm website. Fake apps frequently lack this information.

- Be Wary of New Apps: Avoid new or unrated apps that have few downloads or reviews, as they are more likely to be unverified.

Key Takeaways

- As digital lending becomes popular in Kenya, bogus loan apps have become more frequent, posing concerns to users.

- The Central Bank of Kenya maintains a list of approved lenders; ensure that any loan app you use is included.

- Loan apps that require access to contacts, photographs, or locations frequently abuse this data.

- Borrowers’ reviews provide useful insights into loan app practices, which can help you avoid scams.

- To make more educated judgments, compare apps based on licensing, interest rates, fees, and user reviews.

Conclusion

It is critical to remain watchful in a market inundated with both legit and fake loan apps. You may avoid falling victim to phony loan apps by spotting red indicators, validating your license with the Central Bank of Kenya, and protecting your data. Have you used any of these apps, or do you know anyone who has? How did you manage it?

- 25+ SME GRANTS FOR AFRICANS in 2024 (Updated!!!)

- Savanah Funds: For Tech Startups In Africa

- 10 Best Loan Apps in Nigeria: What You Need to Know Before Borrowing

- Okash Loan: Everything You Need to Know About It

- Microfinance Loans: Definition, Importance, History, Institutions (+ Loan details and Tips)